Philippine Peso Poised for Rebound as Holiday Remittances Set to Arrive

The Philippine peso looks poised to rebound from its record low, with seasonal year-end remittances from millions of Filipinos abroad expected to give the currency a boost.

The peso may strengthen more than 2% to 57.80 per dollar by the end of December, according to Oversea-Chinese Banking Corp. An analyst from Rizal Commercial Banking Corp. expects the currency to rise higher to 57.50 against the greenback.

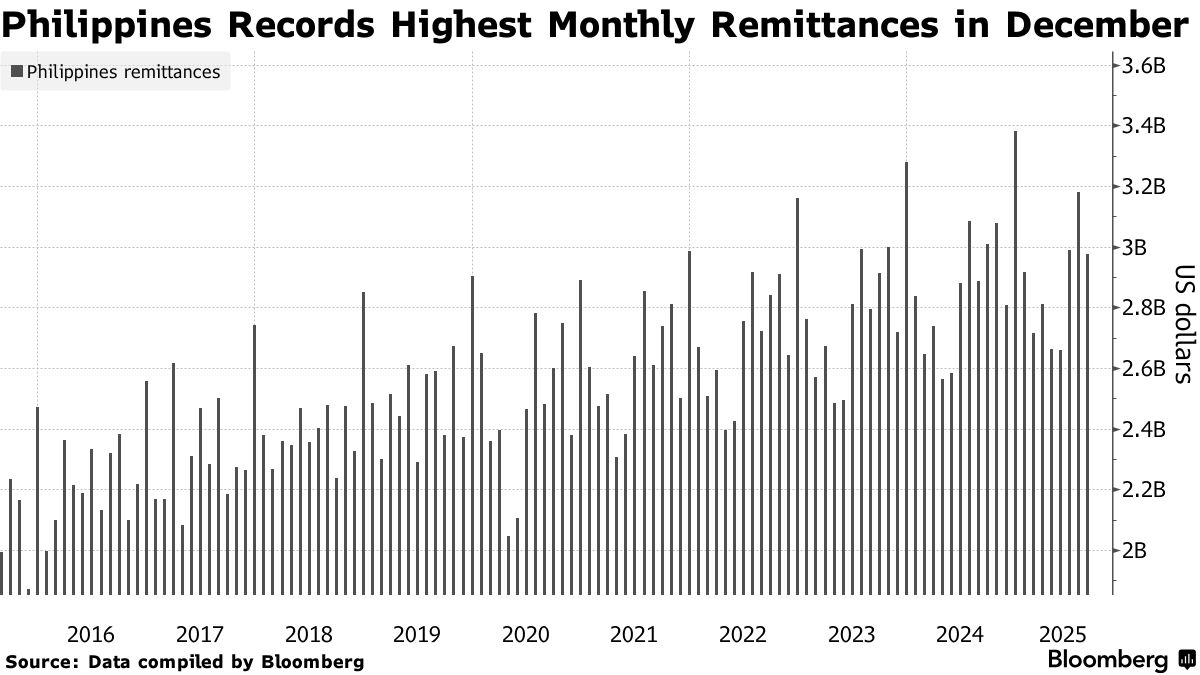

Inflows typically peak in December, helping the peso to gain during the month in eight of the past 10 years, according to Bloomberg-compiled data. Remittances are expected to rise 3% this year, according to the central bank, after reaching the of $34 billion in 2024.

“Remittances will mitigate peso weakness and curb the recent losses,” said Christopher Wong , a currency strategist at OCBC in Singapore. “We also expect domestic uncertainties relating to spending and growth to fade over time.”

Overseas transfers are among the nation’s biggest sources of foreign exchange. The Philippines was the world’s fourth-largest recipient of remittances in 2024, according to the .

The peso has come under pressure following Bangko Sentral ng Pilipinas’s in the benchmark interest rate early October. Sentiment worsened after a member of the Monetary Board on Monday said borrowing cost will likely be lowered by 25 basis points when policymakers meet in December, with more reductions expected in 2026.

The peso fell as much as 0.2% to an all-time low of 59.26 per dollar on Wednesday.

Read:

More than 10 million Filipinos live and work abroad, and most of them send money home to help their families. About 2.02 million Filipinos were deployed overseas from January to August this year, from a year ago, according to the government.

“Fundamentally, the peso should stabilize within the 58 levels, given strong remittances are expected in the next two months,” said Roland Avante , president of Philippine Business Bank.