Yuan Demand in Global Trade Spurs Ebury to Boost China Headcount

UK-based cross-border payment firm Ebury is looking to ramp up hiring in China, driven by local companies expanding trade overseas and the increasing use of the yuan in global commerce.

Ebury, which currently has 10 employees in China, is looking to “double or triple the team size in Shenzhen and Shanghai offices in the upcoming two years,” Mark Lam, head of cross-border trade for Europe and China, said in an interview. About 75% of the firm’s staff is based in Europe.

“We are seeing more companies in China and Hong Kong exploring European markets, or go even farther to regions such as Latin America, Africa,” Lam said. “One of the major changes this year is that it is more acceptable for them to use the yuan to do transactions.’

Ebury’s China expansion underscores rising use of the yuan in cross-border trade as tensions spurred by US tariffs and President Donald Trump’s fiscal policies cast over the greenback. That’s created a for China to advance the yuan’s role in global trade, as would help mitigate foreign-exchange risk.

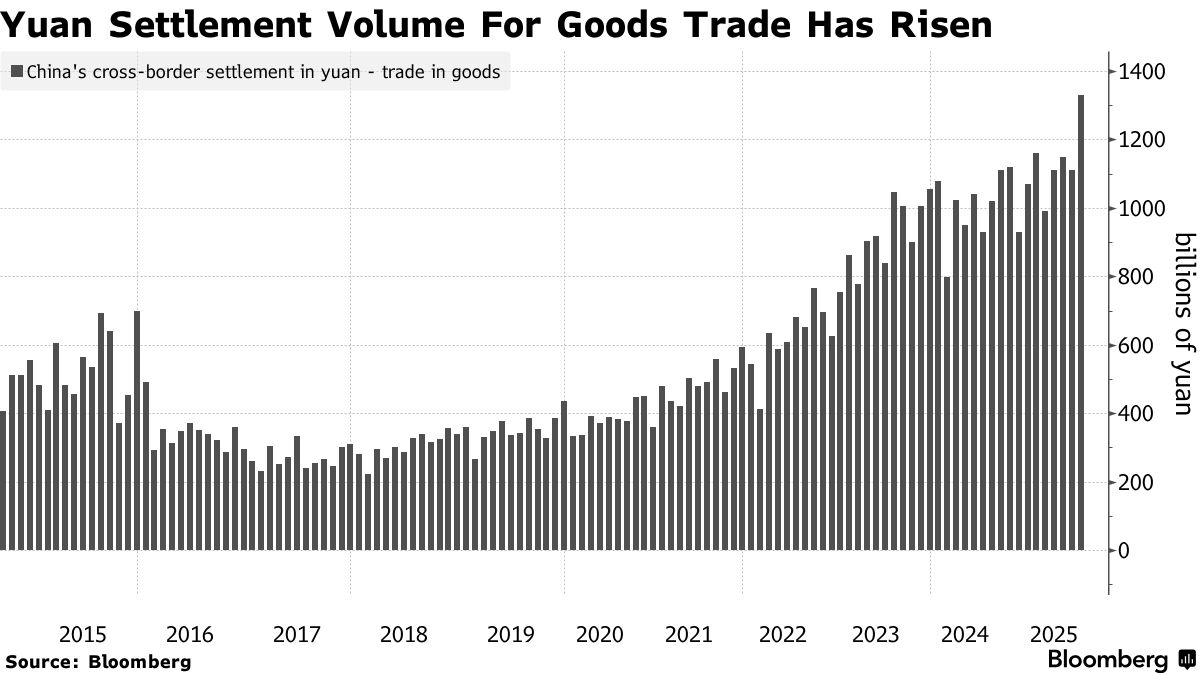

The yuan’s prominence in trade is already on the rise in China. The nation’s cross-border goods trade settled in the yuan in the first three quarters of 2025 rose 12% year-on-year to ($1.4 trillion) and made up roughly 30% of the total trade volume for the period, Bloomberg calculations show.

to diversified markets have also lent support for the currency despite a slump in US shipments. The Chinese currency is set for its biggest annual gain since 2022 while a of the dollar is poised for its largest yearly loss in eight years.

“As everything is made in China, it is more and more welcome to have a quotation in the renminbi,” Lam said, referring to the Chinese currency. Chinese firms are fearful about anything to do with the US, “even if they are not doing business with US companies.”

Up to 70% of Chinese suppliers that Ebury works with accept yuan payments and about 50% of overseas buyers may be open to negotiate payments in yuan, according to Lam. He sees some sectors more keen to trade using the yuan than others.

There is strong interest in the yuan from companies manufacturing light industrial products, clothing, electronics, toys and furniture, according to Lam. Industries like commodities are more reluctant to transact in the yuan given the dollar-based pricing, he said.

“If the Chinese government continues to encourage the usage of yuan in cross-border payment, it will be helpful for the yuan to be an international currency,” Lam said. “We are helping clients to change their habit and transact in the yuan.”