A Trader’s Guide to Navigating General Elections in Chile

Investors have largely priced in a political swing to the right in Chile, yet traders and analysts see further gains if that market-friendly shift is consolidated in Sunday’s general elections.

Bonds, stocks and the currency may gain next week if right-wing contender Jose Antonio Kast secures a place in December’s run-off vote and his side of the political divide secures a majority in Congress. If Kast and poll-leading left-winger Jeannette Jara get through, as expected, investors will pay close attention to the gap between them.

“A right-wing victory is already priced in — what’s not priced in is the legislature,” said Ning Sun , a senior emerging-markets strategist at State Street Markets in Boston. “If Jara gets more than 35% of the vote, it reduces the chances of a right-wing sweep in Congress.”

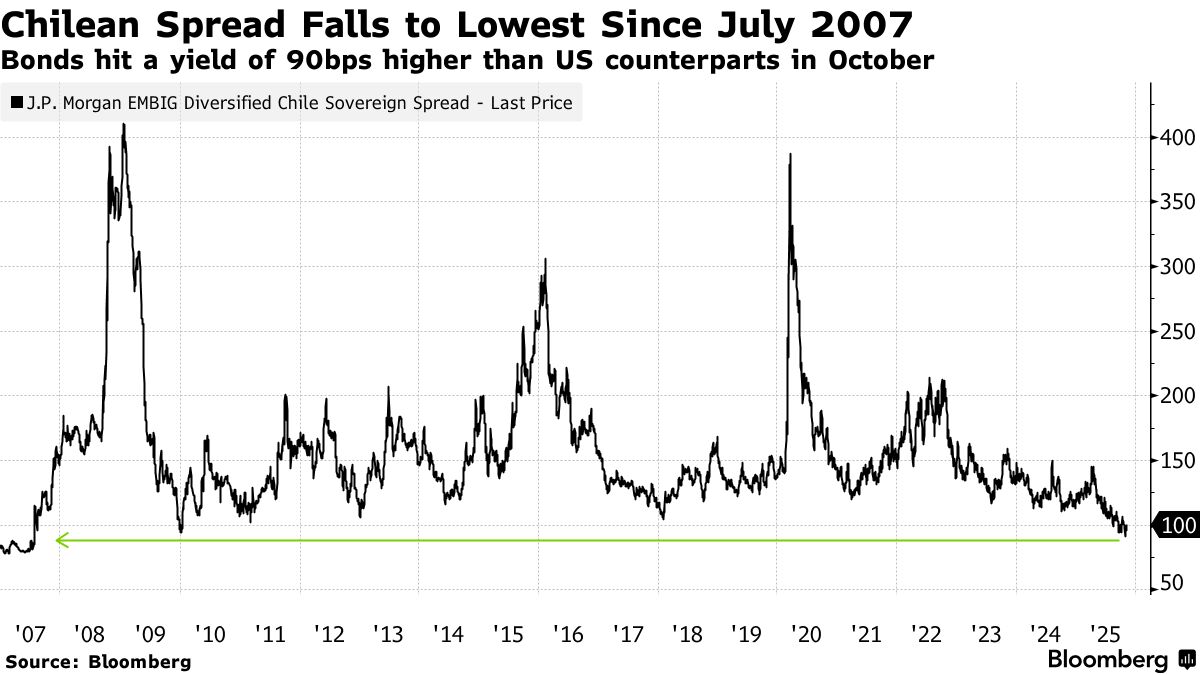

For months, investors have cheered polls showing Kast beating Jara by a wide margin in the Dec. 14 runoff — with bond spreads to US Treasuries near an 18-year low, stocks at record highs and the cost of insuring Chilean debt against default close to pre-pandemic levels. That’s as Kast pledges to clamp down on crime and illegal immigration and cut spending, taxes and red tape.

If Kast lands in a strong position for the run-off, the currency may appreciate around 30 pesos per dollar and the benchmark stock index may add another 1,000 points or more, according to analysts at firms including Bank of America and Deutsche Bank. While the reaction in fixed-income markets may be more subdued, some bonds could also gain further.

“An opposition victory should further improve sentiment toward local assets,” Deutsche Bank strategist Carlos Munoz-Carcamo wrote in a note Friday.

To be sure, surveys in recent weeks have shown rising support for libertarian Johannes Kaiser . Some market gains could be reversed if Kaiser, a more fringe figure on the right, advances. A polling blackout began this month.

While markets would welcome a strong showing for right-leaning candidates — with the peso possibly moving closer to 900 — much will depend on Kast’s priorities and how he interacts with other parties to push through his agenda, said Benito Berber , chief Americas economist at Natixis. “That should limit a little bit the enthusiasm in markets.”

Bonds

Since a peak in April, Chile’s sovereign bonds have tightened 45 basis points versus US Treasuries and credit-default swaps have dropped about 15 basis points. Yields on two-year peso bonds have dipped 45 basis points in the past six months. But there’s still room to gain.

“We continue to recommend adding receivers in 2-3 year sector of the curve,” Deutsche Bank strategists wrote in a separate note, given the peso will strengthen post-elections. “Term premium is low, and positioning is extended, which bodes for keeping low duration.”

Ariel Nachari, strategist at SURA Investments, recommends going a little longer in duration and investing in three- to five-year local debt.

“The upcoming general elections could bring good news for investors, particularly if conservative parties gain a controlling majority in Congress and the Senate,” said William Snead , a strategist at Banco Bilbao Vizcaya Argentaria. “The upside potential may be somewhat limited, as some of the potential good news is already priced in.”

A simulation by data analysis firm Unholster shows the opposition securing dominance in both houses.

Another key factor to follow is if Jara attracts more votes than expected in the first round of voting, breaking through the 30% threshold that many political experts have cited as her limit.

Here are some of the actively traded Chilean sovereign bonds:

The Peso

The country’s exchange rate currently hovers at 940 pesos per dollar, coming off this year’s high of over 1,000. Deutsche Bank sees the currency rallying to 910 by the end of the year on the increasing chances of change in political regime.

But if Kast and Jara head to the runoff, likely leading to a Kast presidency, and the opposition gets a majority in congress, the peso could even appreciate toward 880 in the next three months, according to Deutsche Bank.

“We think the risk-reward ahead of the election favors long CLP,” JPMorgan analysts including Tania Escobedo Jacob wrote in a note last month. “In the more likely scenarios of a divided congress, the distribution of outcomes for CLP could be +8%/-4% versus USD, while in the scenarios where one coalition wins with majority this could be +12%/-10%.”

The peso’s response should be more muted than when leftist President Gabriel Boric was elected given a constitutional referendum was also being discussed at that time. The peso fell 3.5% the day after that election and had weakened as much as 19% four months into his term.

Meanwhile, Bank of America recommends clients bet on gains in Chile’s peso against the euro. “We expect the peso to rally by 8% within six months,” strategists Ezequiel Aguirre and Christian Gonzalez Rojas wrote last week. “In a more moderate bullish outcome, where governability is weaker, we expect a 4% rally.”

Equities

In the run-up to Sunday’s vote, investors have piled into Chile’s stock market. Optimism over a right-wing administration, paired with cheap valuations, has put the IPSA index on pace for its best year since 2003. In fact, the IPSA has seen 65 intra-day records and 54 record closes in 2025.

Pockets of opportunity remain. Shares of banks and builders would benefit the most from a new government, according to Credicorp’s head of equity research Rodrigo Godoy .

“Our IPSA forecast of 10,400 assumes a Congress with a similar composition to the current one,” Godoy said. “If Congress were dominated by the right in both houses, we see the IPSA at 11,200 points.”

LarrainVial strategists also see value in airlines and discretionary retail as they have a greater capacity to capture growth and generate returns. Meanwhile, Bradesco is maintaining its overweight rating on Chilean stocks, while noting Kaiser’s momentum as something to watch.