India’s Rupee Poised for Rebound as Trade Hopes Rise, ING Says

The Indian rupee offers the most potential for gains among Asia’s high yielding currencies next year, according to ING Bank NV, which said a trade deal with the US could fuel a rally in a currency that has lagged far behind most of its peers this year.

The rupee is set to strengthen to 87 per dollar by the end of 2026, ING economists led by Deepali Bhargava wrote in a note dated Nov. 10, implying a roughly 2% rise from current levels. The rupee is among the Asian currencies with the most room to appreciate as it is trading below its estimated fair value based on real effective exchange rate measures, according to ING.

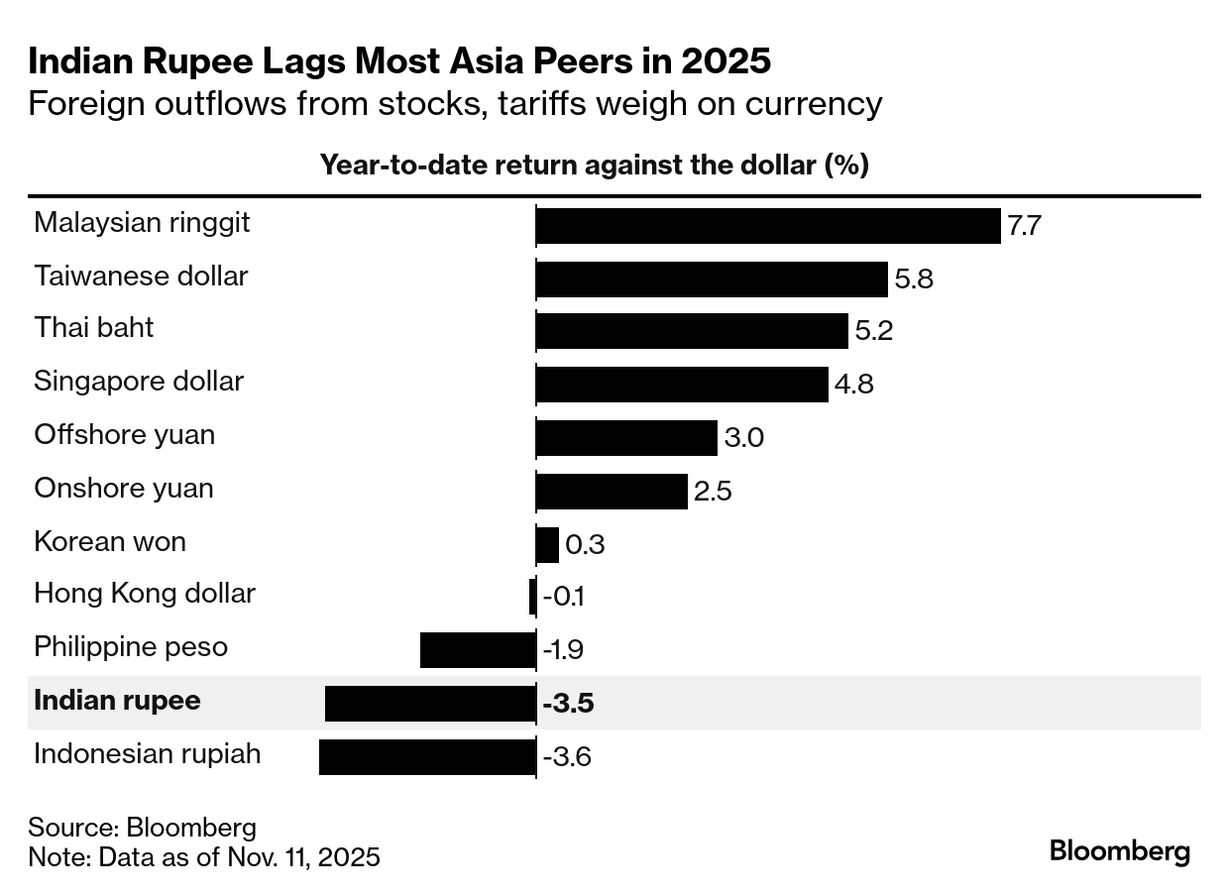

The rupee is Asia’s second-worst performing currency this year, falling 3.5% against the dollar. The currency has been weighed down by a 50% US tariff rate — the highest in the region — which has prompted the central bank to and fend off speculators betting on its decline.

President Donald Trump’s latest that the two nations are close to a trade deal may improve the rupee’s prospects. The rupee was flat at 88.70 per dollar on Tuesday, hovering near record lows after two days of declines.

“Should trade talks turn favorable, the Indian rupee could stage a meaningful reversal,” the economists said. “India remains the standout among high-yielders: fundamentals are solid, fiscal risks are contained, and supply chain diversification continues to attract investment.”

Investors are slowly shedding their pessimism toward Indian assets as stock valuations ease and as bonds remain among the in the region. Goldman Sachs Group Inc. has turned on Indian stocks, joining Societe Generale SA and HSBC Holdings Plc in forecasting a rebound for Indian equities.