Reeves’ Latest Reversal Leaves Britain Exposed to Next Crisis

Rachel Reeves has boxed herself into a corner and left the UK government exposed to future fiscal shocks, economists warned, after the Chancellor of the Exchequer on plans to break Labour’s election manifesto by raising income tax.

Although the decision was taken after the Office for Budget Responsibility handed her a less-bad-than-expected fiscal forecast, the volte-face nonetheless followed a week of party infighting and public concerns that put the politics of the budget front and center.

Reeves’ U-turn gave the impression of “political weakness,” said Michael Saunders, a former Bank of England ratesetter who is now senior adviser at Oxford Economics. “By showing they are not willing to raise income tax, they are less able to address future fiscal problems when they emerge.”

Labour’s chancellor had been laying the groundwork for a breach of the party’s manifesto promise not to increase income tax, national insurance or VAT, which together account for two-thirds of all tax revenues.

In a speech at the start of last week, described by the government as a “scene setter” for the budget, “each of us must do out bit” and subsequently strengthened the message in an interview on Monday in which she said the to breaching the manifesto would “require things like deep cuts in capital spending” that she has effectively ruled out.

However, there followed days of political infighting amid growing concern that Prime Minister Keir Starmer might face a leadership challenge if the budget landed badly. Treasury officials then briefed that income tax cuts had been taken off the table.

One reading was that it was a concession to angry Labour backbenchers who feared for their seats if trust with the electorate was broken. It would not have been the first time backbenchers took the reins. In June, Labour MPs overturned plans for £5 billion of welfare cuts.

With spending cuts and increases in broad based taxes now looking politically improbable, Reeves has few options in the event of another fiscal shock.

The chancellor’s U-turn “raises the risk that she relies on smaller, back-loaded measures to boost revenue in the budget, which would further play into concerns about the UK’s fiscal credibility,” said Bloomberg Economics economist Ana Andrade .

Markets were not impressed, with 10-year yields rising 14 basis points on Friday. That’s the biggest jump since July 2, when Reeves’ in Parliament prompted speculation about her future.

Billion by billion

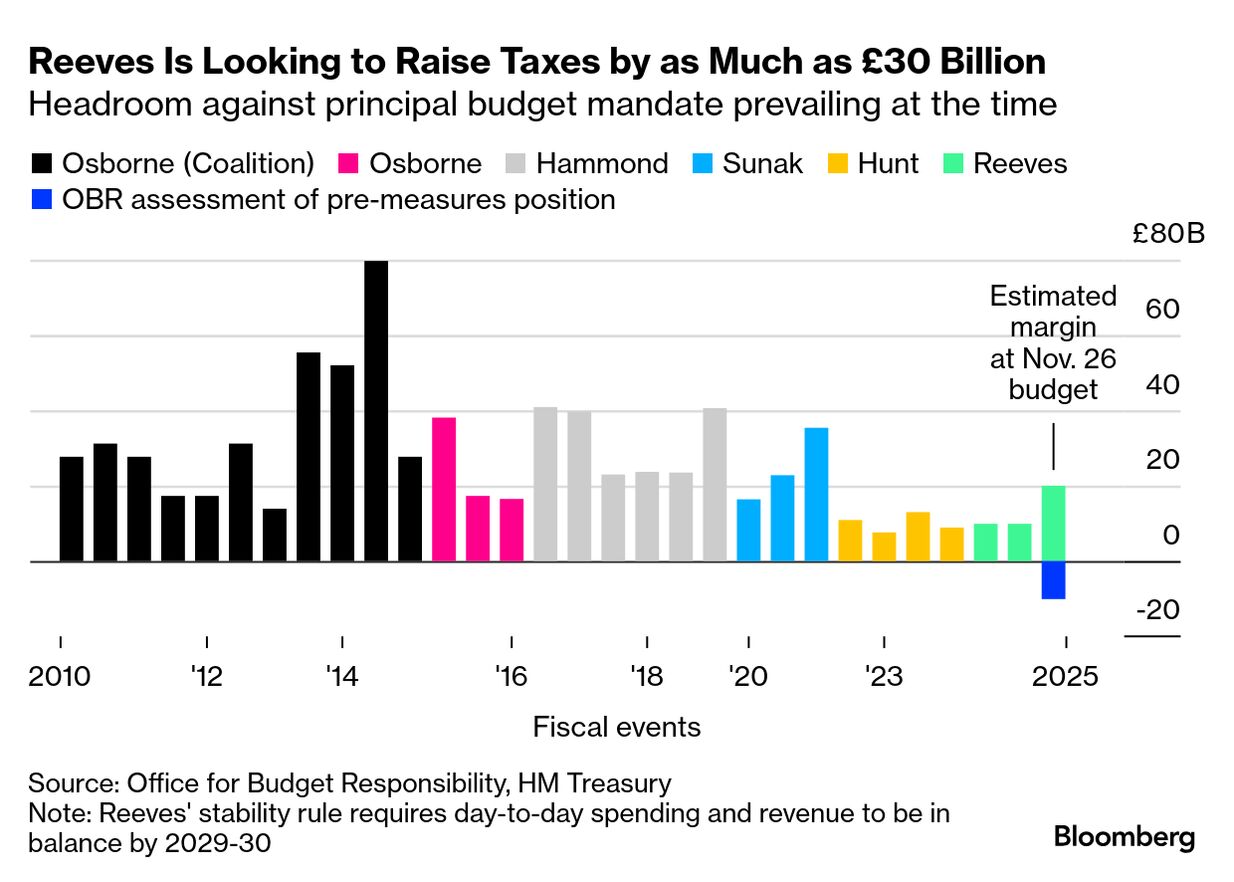

On the face of it, the OBR delivered the chancellor good news with its first post-measures forecast on Monday, which put the fiscal deterioration at £20 billion, less than the £30 billion-plus some feared. But she still faces a significant challenge.

Reeves needs to fill the £20 billion budget hole and has indicated that she wants another £10 billion to double the headroom against her fiscal rules. Instead of pulling one or two big levers to secure this £30 billion, she will now have to raise several taxes, making it more likely the budget will unravel and leave nothing in the tank for the future.

“Were they to raise income taxes, that would leave plenty of fiscal capacity for another shock. Now she will have to use that up at this budget,” Saunders said.

To raise the funds, Reeves is expected to freeze income tax thresholds for two more years, which the Resolution Foundation think tank expects to generate £7.5 billion, though the figure may be higher if the OBR has upgraded its earnings forecast. Spending plans in the final year of the forecast could be trimmed to secure another £5 billion.

As Reeves is expected to announce an end to the two child benefit, at a cost of £3.5 billion, she will have to find at least another £21 billion. If she freezes fuel duty to keep inflation under control, as widely expected, the target rises to £26 billion.

Labour is looking at property taxes, salary sacrifice pension relief, capital gains tax, and levies on landlords and gambling, which Saunders described as “salami-slicing” the budget measures.

‘Pre-budget circus’

The government’s reliance on smaller revenue raisers “heightens the likelihood of a negative market response ahead of, and immediately after the budget,” said Maxime Darmet, senior economist at Allianz Trade. “Investors generally view large, broad-based tax measures, such income tax and VAT, as more credible tools for plugging fiscal gaps.”

Andrew Wishart at Berenberg said backloaded measures, such as freezing thresholds and end-of-forecast spending cuts, may be politically attractive but are “less credible.”

He added: “Relying on spending cuts in 2029-30 and tax hikes on wealthy and high income individuals, where the behavioral response could limit the revenue gained, is less likely to convince bond investors.

“The result will be a smaller and messier fiscal tightening that risks this pre-budget circus being repeated ahead of future fiscal events.”

Another danger to which markets are alert is the credibility of the OBR’s forecast. Mahmood Pradhan, head of global macro at the Amundi Investment Institute and a former deputy director in the European department of the International Monetary Fund, said it was essential that the budget forecast “convinces markets there was no OBR optimism.”

Reeves’ watchdog has dealt her a blow by lowering its productivity growth projection by 0.3 percentage points, or as much as £20 billion. But it has raised its forecast of workers’ earnings, people familiar with the matter told Bloomberg, making the economy more tax rich.

The question is whether the market believes it.