Traders Are Bracing for Pound Volatility as UK Budget Draws Near

Traders are paying up for protection against swings in the pound leading into the UK Autumn Budget.

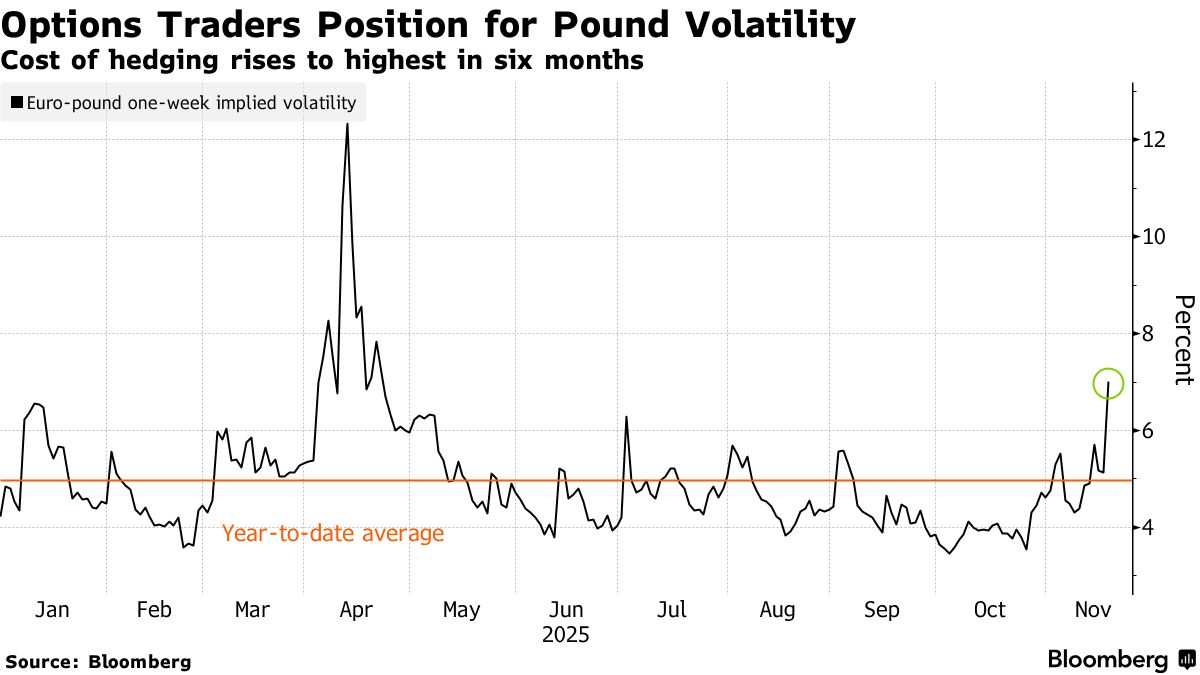

The cost of one-week options, which now span the Nov. 26 event, has climbed to multi-month highs for major sterling pairs.

The sharpest move was in euro-pound, where one-week implied volatility is at a six-month high. Pound-Swiss franc hedging costs are near a four-month peak, while the pound-dollar measure is at levels last seen in early September.

The spread of implied volatility over realized price swings in euro-pound is now at the highest since April, signaling that traders are willing to pay up for near-term insurance.

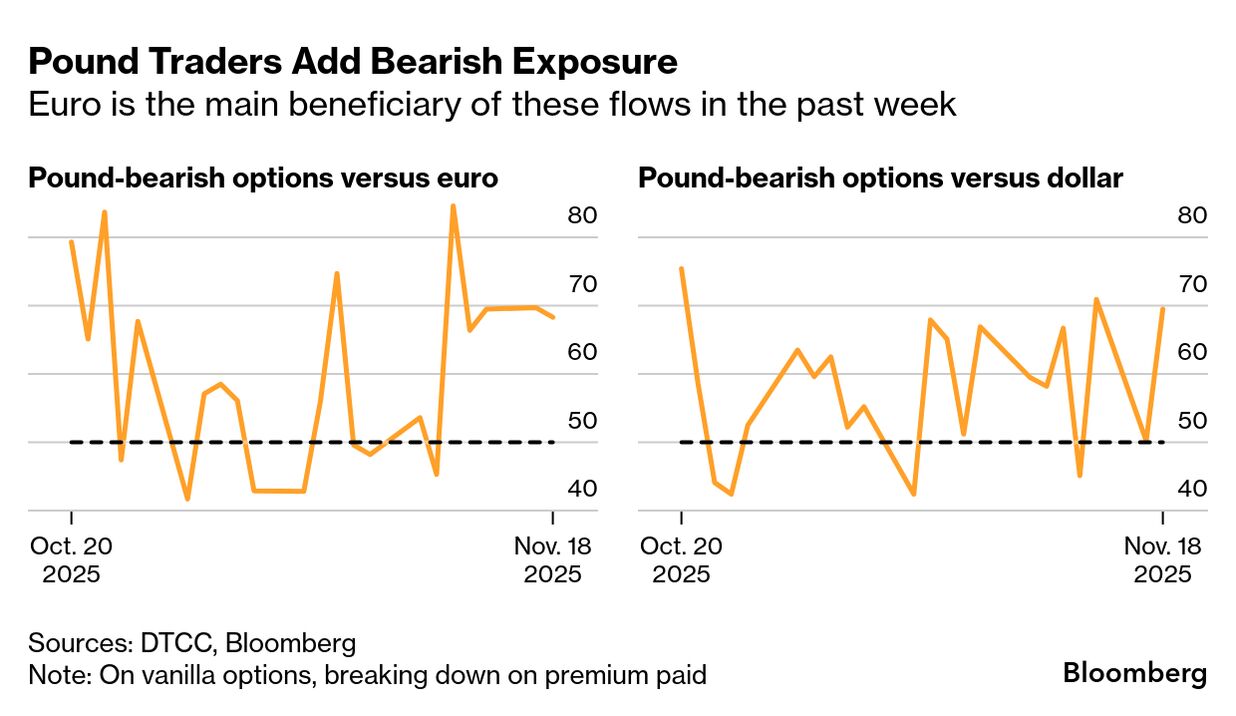

Flows point to negative sentiment on the pound, reflecting fiscal concerns. Data from the Depository Trust & Clearing Corporation over the past month show more bearish than bullish structures versus both the euro and the dollar.

Still, the euro leg saw the bigger pickup in the past week. For directional bets, many see it as the cleaner way to express UK-specific risk, with the dollar side muddied by US data and headlines.

What Bloomberg Strategists Say...

Spot moves were modest on Wednesday after data showed UK inflation fell in October for the first time in seven months, even though money markets ramped up bets for Bank of England interest-rate cuts. That’s another sign fiscal risk is eclipsing monetary policy for FX traders.