Traders Watch for RBI Presence After Rupee Enters Uncharted Zone

India’s rupee may weaken further, according to analysts, who are watching the central bank’s willingness to defend a currency buffeted by the harshest US tariffs in Asia.

The rupee tumbled as much as 0.9% on Friday to a record low of 89.4812 per dollar, nearing what is a psychologically crucial level at 90. The move caught traders , as the Reserve Bank of India had for months defended the previous low around 88.80, and has some game-planning for what might come next.

“The rupee may easily breach 90 in the absence of the RBI,” said Ritesh Bhansali, deputy chief executive officer at Mecklai Financial Services Ltd., pointing to levels in the offshore market. He expects the central bank to step in at 90 to 90.50 per dollar to prevent a “free-fall,” which might attract speculative trading.

The rupee is Asia’s worst performer this year, and further weakness might exacerbate outflows from local equities, while also posing future inflation risks as India is a net importer of fuel. The country’s trade deficit widened to a record in October, with exports to the US plummeting a second straight month after the imposition of 50% tariffs.

On Monday, the rupee’s one-month offshore non-deliverable forward rate was at 89.70, after jumping more than 1% on Friday. Over the past few weeks, the RBI has often to sell dollars in the offshore market to support the rupee around 10 to 15 minutes before onshore trading commences at 9 a.m. in Mumbai.

Read More:

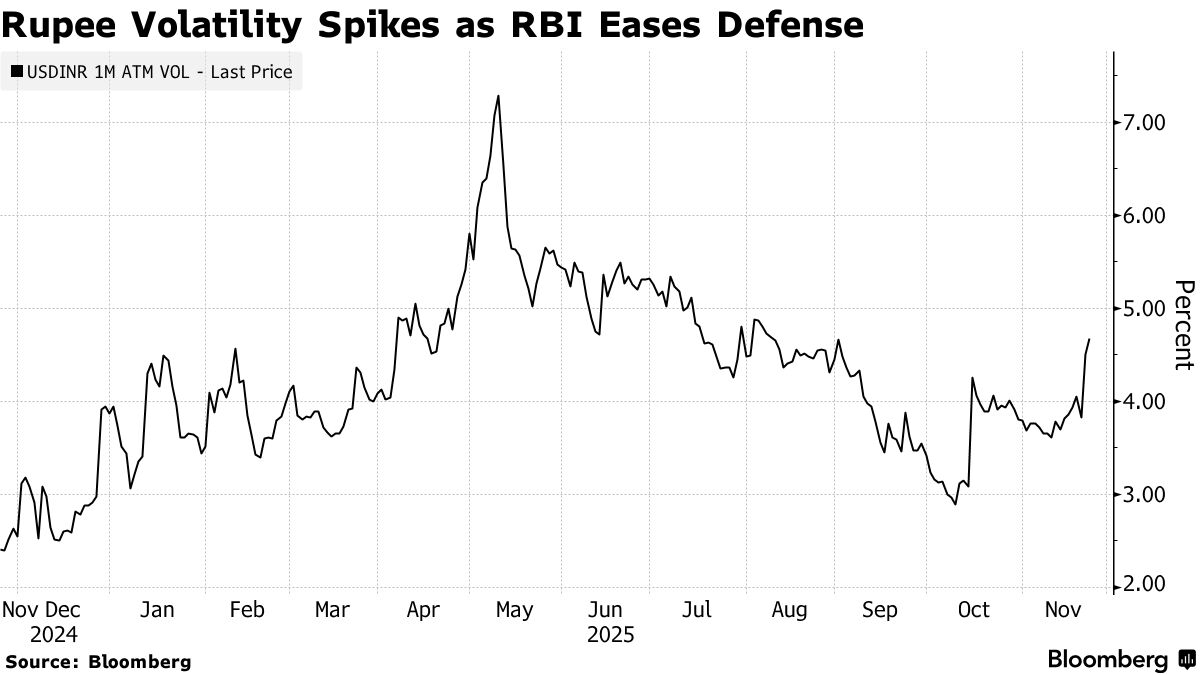

“On the back of a higher-than-expected trade deficit, net financial flows have been on the weaker side, thereby pressuring the rupee to depreciate while RBI had been containing the volatility,” wrote Yes Bank economists including Indranil Pan , in a note.

With the rupee now in uncharted territory, predicting levels would be difficult, but the currency should be capped at 90 per dollar, they said.

Following its recent currency market interventions, the RBI’s foreign-exchange reserves have dropped around $10 billion since mid-September, data released after trading hours on Friday showed.

Overall pressure on the currency is likely to remain for now, says Rajeev Pawar , head of treasury at Ujjivan Small Finance Bank, pointing to uncertainty on US rate cuts and concerns over the Japanese yen as headwinds.