China Should Raise Imports to Promote Yuan, Ex PBOC Adviser Says

China should increase imports and settle them in the yuan to balance its foreign trade, a move a former central bank adviser says will boost the Chinese currency’s usage globally.

Foreign trade strategy for China requires major adjustment in the next five years, Liu Shijin , a former member of the People’s Bank of China’s monetary policy committee said in a speech last week. It’s necessary to achieve a basic balance between imports and exports, he said.

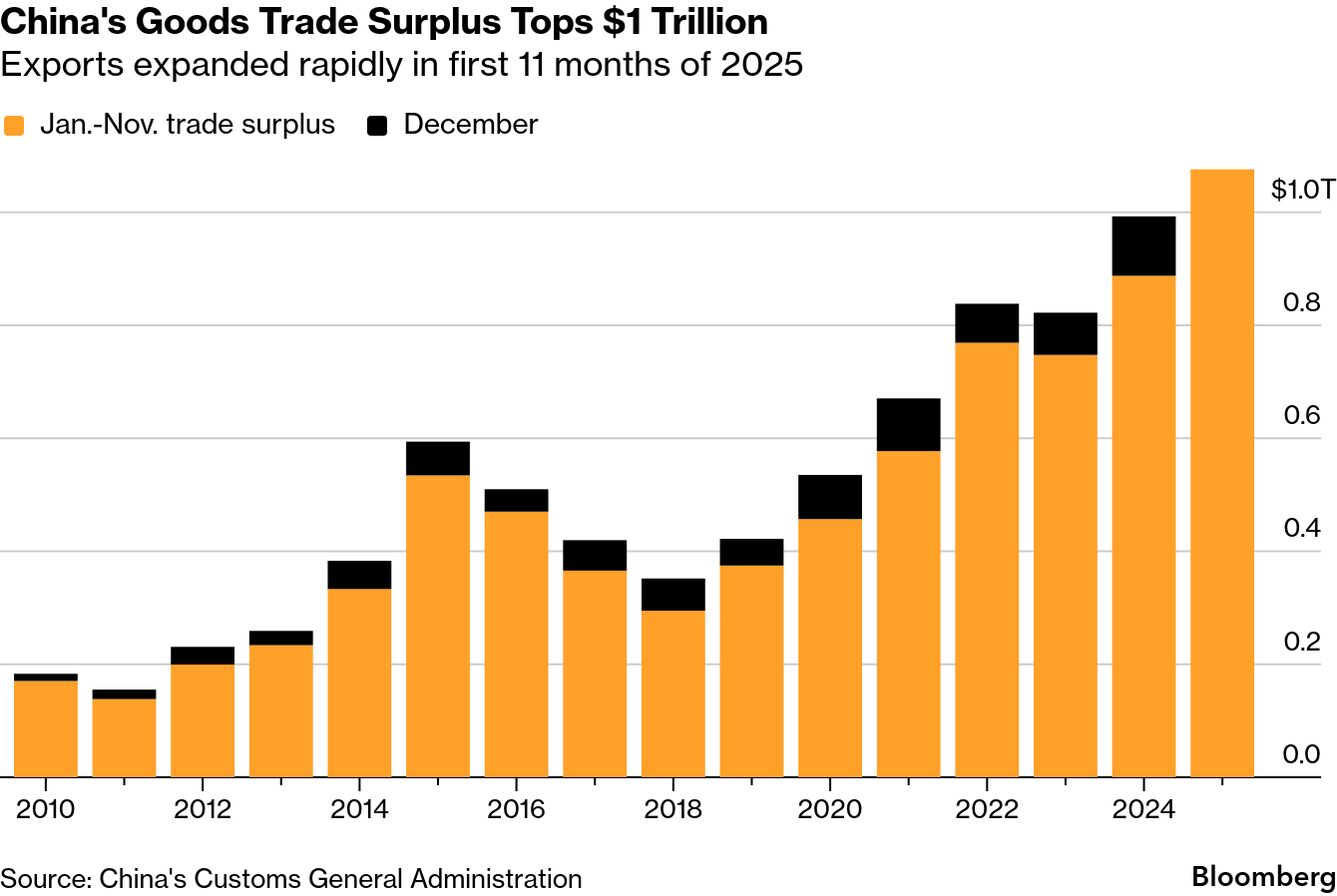

“China’s trade surplus was about $1 trillion last year,” Liu said. “If China can import more goods and services equivalent to that scale and pay in the yuan, it will significantly boost the offshore yuan liquidity.”

Liu, who was also previously a deputy director of a research affiliate to the State Council, said encouraging a reasonable appreciation in the yuan would also help internationalize the currency. This move would increase the purchasing power of Chinese residents abroad and boost , he said.

While Liu’s views don’t represent official policy, they highlight growing international pressure to re-balance trade. The latest warning came from French President Emmanuel Macron who said the European Union may be forced to take against China, including potential tariffs, if Beijing fails to address its widening trade imbalance with the bloc.

Beijing has already vowed to in the next five years to be less reliant on exports. China’s top leaders made their top economic priority for 2026, to buffer the economy from global trade risks, according to a readout for the Communist Party’s decision-making Politburo.

So far China’s economic transition remains slow, with slowing for the fifth straight month in October, while a rebound in exports pushed the nation’s trade surplus past last month.

Meanwhile, China has also taken a more tone on pushing the currency’s role globally, with the dollar’s safe-haven status under pressure from fiscal woes and concerns over the Federal Reserve’s independence.

To accelerate the yuan internationalization process, China should also expand its yuan-denominated financial products in the offshore market. These products include bonds, stocks, funds, and derivatives, according to Liu.

“The share of yuan’s global usage should be lifted to become more compatible with the status of the Chinese economy,” Liu said.

Liu served as an adviser on the PBOC’s monetary policy committee between June 2018 and March 2024.