Taiwan Insurers Slash Currency Hedges to Record as Reserves Rise

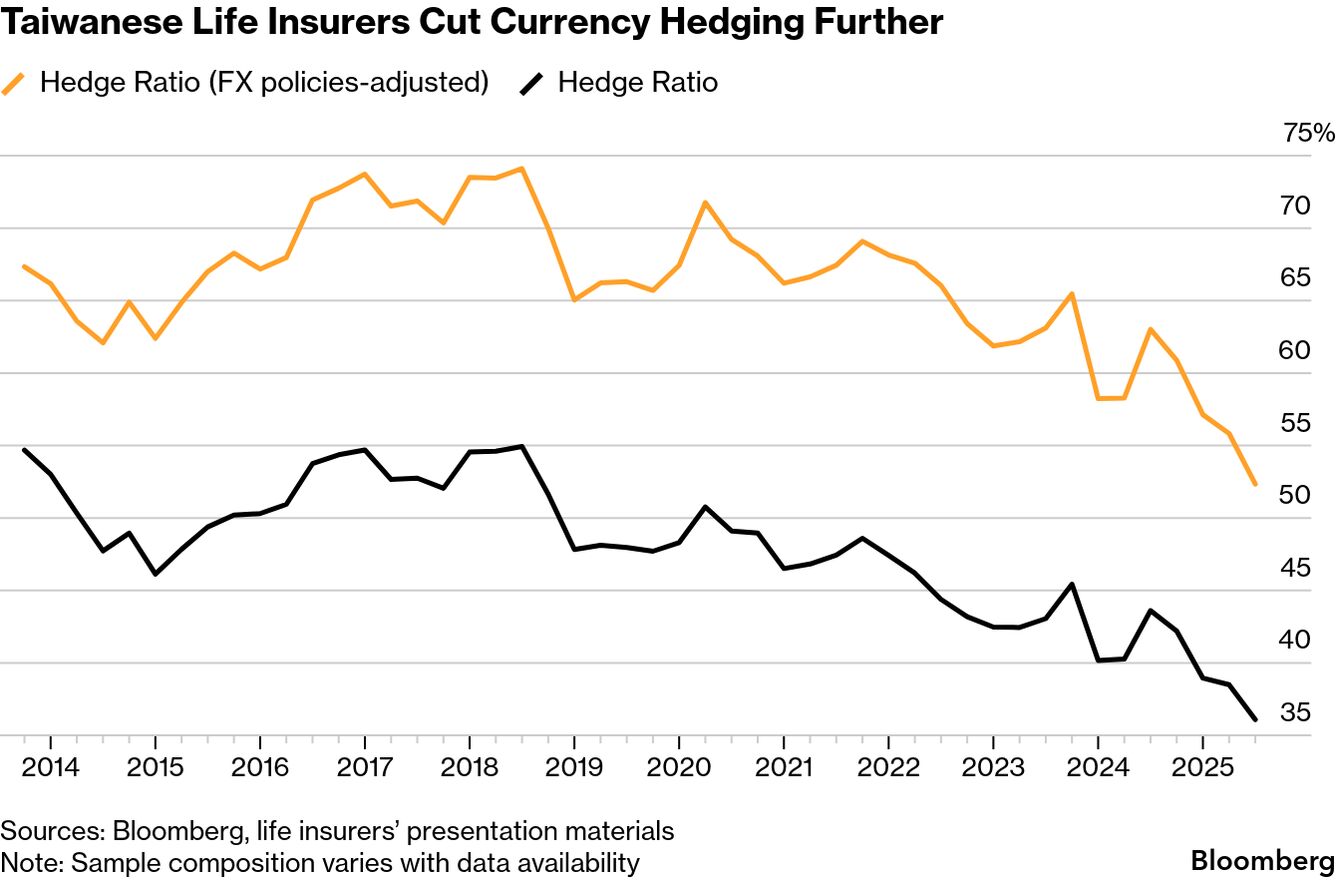

Taiwan’s life insurers have cut their currency hedging to a record low, while boosting their buffer against foreign-exchange risks to give themselves a greater capacity to ride out any potential volatility.

Derivatives such as forwards and currency swaps covered 52.3% of life insurers’ overseas assets as of Sept. 30, based on the latest data from the six largest firms. That’s down from 55.8% on June 30, and the lowest since the comparable data became available in 2013. The analysis strips out foreign-currency denominated insurance policies that don’t need hedging.

The decision of insurers to reduce hedging may increase the risk of another surge in the Taiwan dollar similar to that which took place in May, when the currency had its biggest monthly gain in more than 30 years. The rally was partly attributed to insurers’ decision to boost hedging ratios, a move that typically generates demand for the local currency.

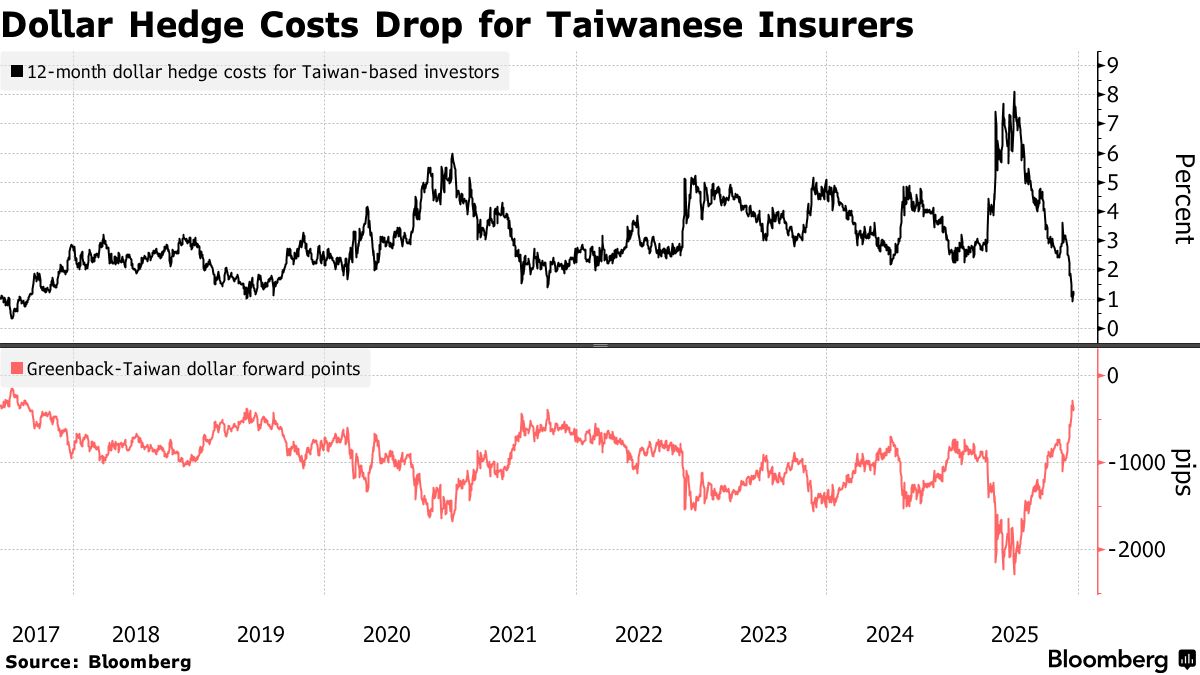

Insurers are cutting their hedging again even though the cost of doing so fell this month to the lowest level in eight years. The companies increased the size of their currency reserves as the industry seeks changes to accounting rules that will lower hedging costs and provide relief for excessive currency swings.

Proposed regulatory changes to reduce hedging costs are unlikely to sufficiently curtail the foreign-exchange risks of life insurers, according to Nomura Holdings Inc. “If the US dollar were to build downside momentum, lifers’ US dollar-selling FX hedging will still likely pick up,” strategists including Craig Chan in Singapore wrote in a research note this month.

The life-insurance units of some of the island’s largest finance firms, including , and , have boosted their total currency reserves to NT$180 billion ($5.7 billion), up 58% from June, according to Bloomberg calculations.

The Financial Supervisory Commission, the island’s main financial regulator, will carry out a feasibility study on the proposed FX accounting rule changes, Central News Agency reported last month, citing an executive at the commission’s insurance bureau.

A reduction in hedging activity results in less selling of US dollar-Taiwan dollar non-deliverable forwards, putting upward pressure across the entire forward curve, Chun Him Cheung , an emerging Asia fixed-income and foreign-exchange strategist at Bank of America, wrote in a research note last week.