Euro Rally Seen Pushing Ahead if ECB Widens Policy Gap With Fed

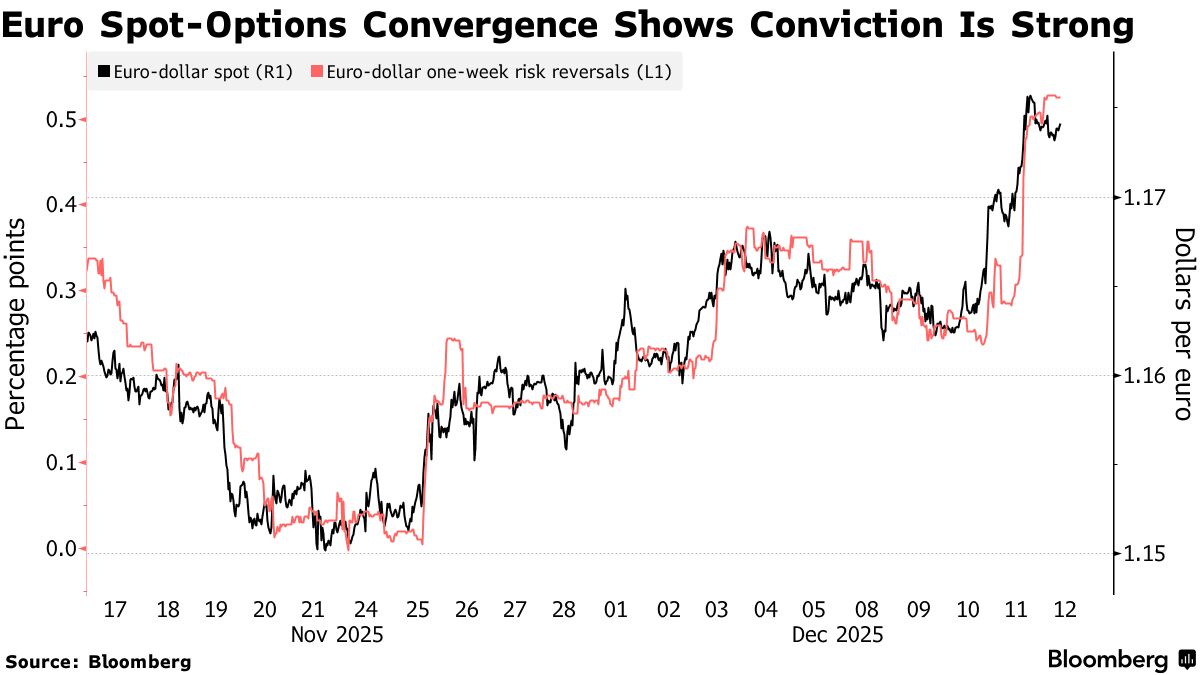

Options traders expect the euro’s rally to get fresh impetus next week with the European Central Bank ’s meeting expected to underscore its policy divergence with the Federal Reserve.

Statistics from the Depository Trust & Clearing Corporation show the most active trading this month is at $1.18 per euro, with the bulk in terms of underlying value clustered in contracts maturing on Dec. 18-19 — the ECB rate decision window. Those flows suggest the currency will be trading above that level by the time policymakers are done.

The common currency is hovering near a more than two-month high after a third straight rate cut by the Fed this week and hawkish from ECB executive board member Isabel Schnabel. Options sentiment into the ECB’s Dec. 18 decision is now the most bullish in nearly three months.

Buying volatility before the decision is the most expensive it has been in three months, which traders link to the Schnabel remarks. Even if the central bank doesn’t hike rates next year year, Morgan Stanley strategists still see the euro rallying to $1.30 by the second quarter of 2026.

Euro’s Path to $1.30 Needs a Full Dollar Down-Cycle: Trader Talk

Hedge funds have been the main drivers of this week’s bullish euro price action, snapping up vanilla and exotic options that will make money if the euro strengthens, according to FX traders familiar with the flows, who asked not to be identified because they aren’t authorized to speak publicly.