Yuan Rally Offers Little Relief for China Stocks on Growth Woes

The yuan’s recent strength is doing little to boost Chinese stocks as mounting concerns over economic weakness and rising valuations sap sentiment toward equities.

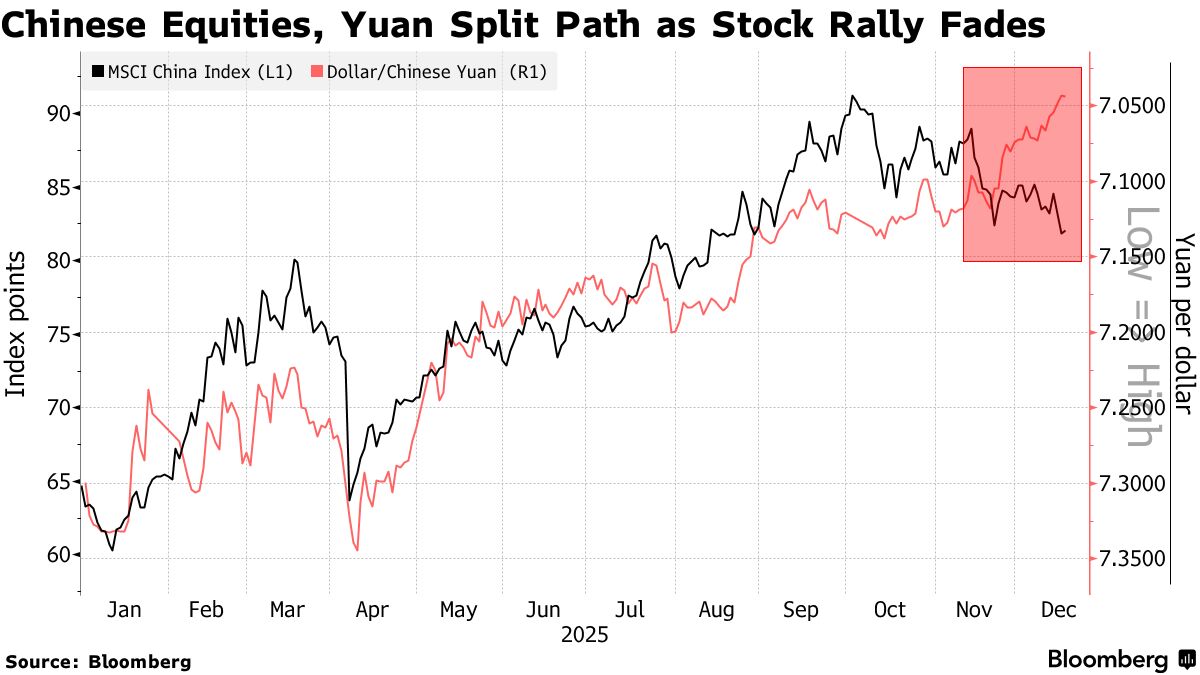

An MSCI gauge of Chinese stocks entered into this week as the latest economic data pointed to a further deterioration in domestic demand. Meanwhile, the yuan advanced to the strongest level in 14 months.

That decoupling may persist as investors reassess China’s economic recovery and the outlook for corporate earnings. The 20-day correlation between the MSCI China Index and the yuan — which averaged about 0.3 over the last eight years — has fallen to minus 0.3, the lowest in more than a year.

“This divergence is quite important — it suggests capital is currently more comfortable expressing China exposure through foreign exchange and rates rather than equities,” said Dilin Wu , research strategist at Pepperstone Group in Australia. “Until clearer progress emerges on earnings recovery and confidence in domestic demand, equity markets are likely to lag even if the yuan remains supported.”

Chinese stocks have previously moved in tandem with the currency, as a stronger yuan supports capital inflows. It also tends to bolster earnings for some Hong Kong firms that generate revenue from the mainland, while lowering the cost of imports and foreign debt.

However, equities have come under pressure amid a slow recovery in , a deepening real estate crisis and a reluctance by Beijing to unveil sweeping stimulus. Investors have also become cautious after a DeepSeek-fueled surge earlier this year pushed up equity valuations.

On the other hand, the yuan is heading for its best annual performance in five years, supported by stronger fixings and a slide in the dollar. China’s push toward more domestic-driven growth is also fueling speculation that policymakers will allow in the managed currency. Goldman Sachs Group Inc. estimates that the yuan is undervalued by a quarter relative to economic fundamentals.

Positive Signal

The breakdown in the correlation between Chinese stocks and the yuan may be short-lived due to the potential for renewed capital inflows.

“A firmer yuan can lift domestic sentiment through both wealth and confidence channels, and currency stability helps support equities, property, and household wealth,” said Christopher Wong , a currency strategist at Oversea-Chinese Banking Corp. “It also sends a positive signal to foreign investors, lowering perceived FX risk and encouraging portfolio inflows into yuan assets. Overall, we continue to look for a measured and orderly pace of appreciation in yuan into 2026.”

Global fund managers, including Amundi SA and Fidelity International, also expect Chinese stocks to next year on the country’s artificial intelligence prowess and resilience amid US tensions. The MSCI China Index has risen almost 28% this year, beating the regional and almost doubling the gain in the S&P 500 Index.

Still, stocks are “constrained by the growth ceiling,” given the lack of clearer evidence of demand and profit recovery, said Hebe Chen , senior market analyst at Vantage Global Prime Pty Ltd.