Pound Drops Most in a Month as UK Inflation Misses Estimates

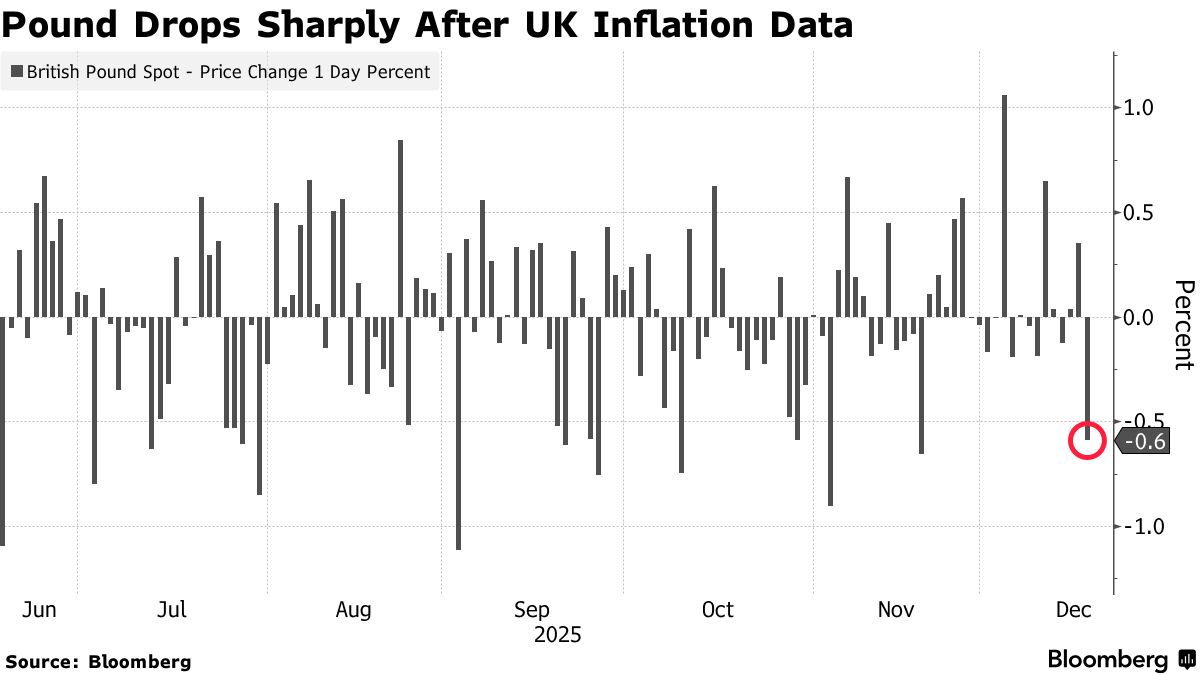

The pound headed for its biggest one-day drop in a month after UK inflation came in softer than expected, boosting bets that the Bank of England will have to deliver more interest rate cuts next year.

Sterling dropped 0.8% to $1.3316, its lowest level in a week, and the UK 10-year yield fell by seven basis points to 4.45%. Money markets added to BOE rate cut bets, pricing 67 basis points of easing by the end of next year compared to 58 ahead of the data.

Ηedge funds sold the currency in the cash market versus the euro and the dollar following the data, according to FX traders familiar with the transactions who asked not to be identified because they aren’t authorized to speak publicly. Rates traders added to bets.

Read More:

Consumer prices rose just 3.2% in November after a 3.6% increase the previous month, dragged lower by the falling price of some foods such as cakes, biscuits, and breakfast cereals, the Office for National Statistics said on Wednesday. That was below the 3.5% expected by economists and the BOE’s prediction of 3.4%.

While the bigger-than-expected drop clears the path for a BOE interest-rate cut on Thursday, one-day implied volatility in the pound sits around 10% — which suggests that traders don’t expect fireworks as a rate cut is essentially priced in.

Options pricing has turned more bearish on the currency in the short-term, with risk reversals showing a premium for the dollar.