Indian Rupee Stages Late Rally on Strong RBI Intervention

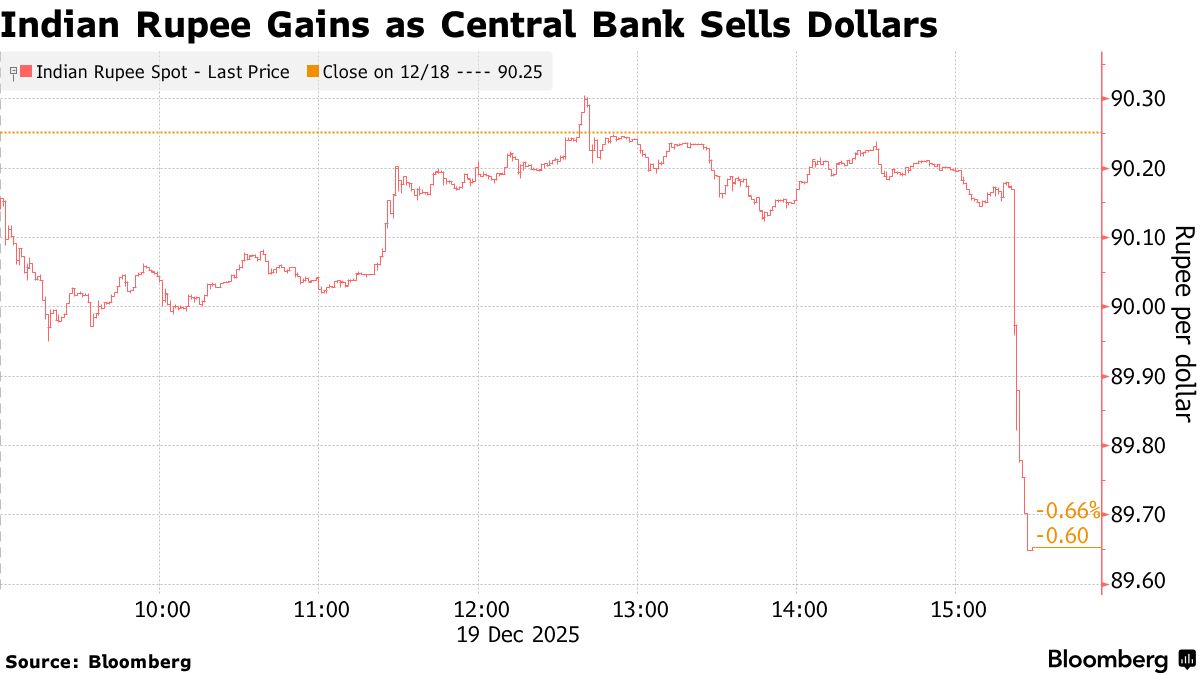

The Indian rupee surged sharply in the final minutes of Friday’s session after the nation’s central bank sold dollars aggressively, a move traders said was intended to stamp out speculative bets against the currency.

The rupee climbed 0.7% to close at 89.6525, with the bulk of the gains coming in the last 10 minutes of trading. The Reserve Bank of India intervened through dollar sales in the local market, according to people familiar with the transactions. Friday’s move comes after a forceful intervention on Wednesday that drove an intraday gain of 1% in the currency.

“Intervening heavily toward the close kills speculation because it does not give reaction time to speculators,” said Ritesh Bhansali , deputy chief executive officer at Mecklai Financial Services. “This is what was missing from the RBI till now.”

The central bank’s move comes after the rupee tested a series of record lows in recent weeks. The currency is still down 4.5% against the dollar this year, weighed by almost $18 billion of outflows from stocks and delays in finalizing a trade deal with Washington.

This week’s aggressive dollar sales helped the rupee post its biggest weekly jump since June.

“Speculators would be wary hereon to take one-sided short trades against the rupee,” said Sajal Gupta , head of forex and commodities at Nuvama Institutional desk. The decisive action by the RBI is expected to bring some much-needed stability to the rupee, Gupta said.

Read More: