Traders Highlight Risks for Japan Going Solo on Yen Intervention

Traders are questioning how effective Japan could be if it were to intervene alone to support the yen, after US Treasury Secretary Scott Bessent cast doubt on the prospect of coordinated action.

Those hopes were dented after Bessent on Wednesday the US is “absolutely not” intervening in the dollar-yen market, helping trigger an as much as 1.2% slump in the yen — its biggest in more than five weeks. Earlier, speculation of so-called rate checks by the Federal Reserve of New York gave the yen a lift, nudging the pair toward the 150 handle.

While the yen is still some distance from levels widely viewed as triggering imminent intervention, traders are once again forced to assess how Japan might respond if the currency were to sell off sharply between now and the snap lower house election on Feb. 8.

“Markets might test the Ministry of Finance’s tolerance and push dollar-yen back up, now that a joint intervention is unlikely,” said Carol Kong , a strategist at Commonwealth Bank of Australia. “Without US involvement, any intervention by the MOF alone would be far less effective in countering downward pressure on the yen, meaning any post-intervention gains are likely to fade quickly.”

Beyond intervention, investors point to weak fundamentals that continue to weigh on the yen. Real interest rates remain negative, with inflation still running above 2%, while overnight index swaps suggest traders are pricing in just two Bank of Japan rate hikes this year — reinforcing the view that policy remains behind the curve.

Fiscal risks are also swirling. The ruling Liberal Democratic Party is seen securing a majority in the upcoming election, intensifying concerns around aggressive fiscal stimulus and putting pressure on the currency.

“Fundamentals have not changed — the BOJ is running an easy policy and the Takaichi government is planning an unfunded expansionary fiscal policy,” said Rodrigo Catril , a currency strategist at National Australia Bank Ltd. “Unless we see a shift in BOJ policy, FX intervention is unlikely to have a longer lasting impact on the yen.”

The US side of the equation also complicates matters. Any Japanese intervention would likely require US acquiescence given it would put downward pressure on the dollar, making it a sensitive issue at a time when talk of the greenback’s is gaining traction among investors.

“From a US perspective, intervention without a coincident shift in monetary policy fundamentals is less appealing due to the lower probability of long-term success,” said Tony Sycamore , a market analyst at IG Australia. “After Bessent’s comments I think we will head back toward 155 pretty quickly, with the scope to test 158 before the market becomes more cautious again.”

In Japan, intervention decisions are made by the finance ministry and executed by the BOJ through a handful of commercial banks, typically involving dollar sales to support the yen in the spot market.

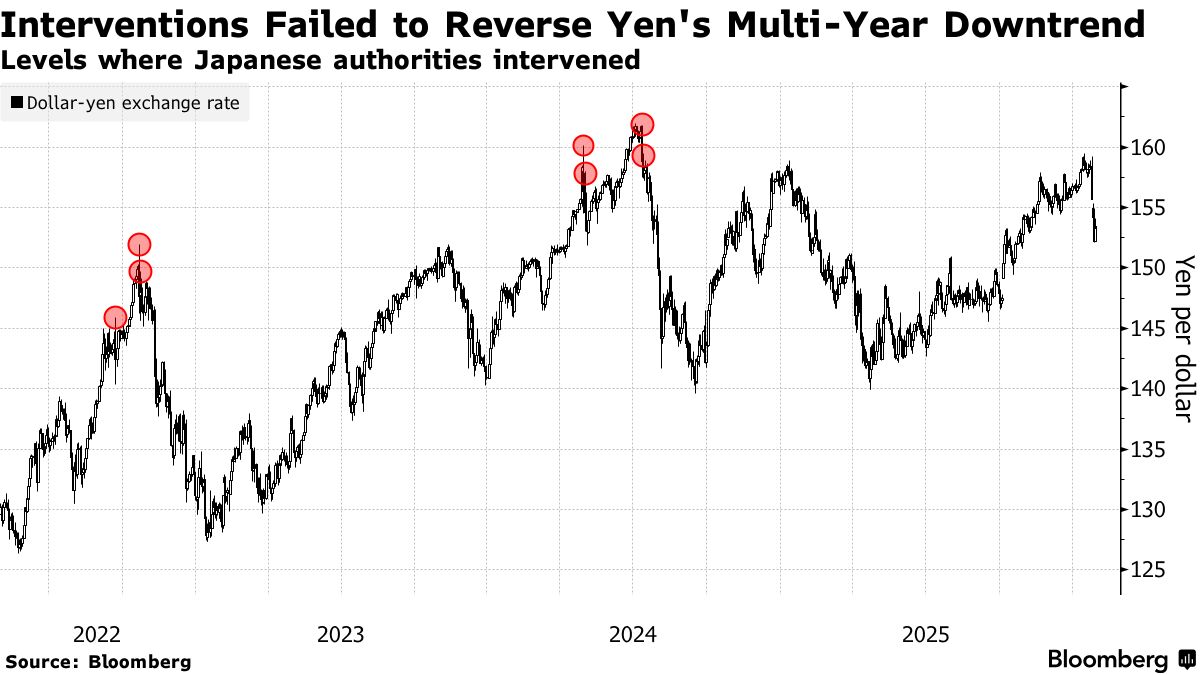

History suggests unilateral action offers only temporary relief. Japan four times in 2024, lifting the yen briefly each time, but failed to reverse the broader multi-year downtrend as markets repeatedly tested policymakers’ resolve.

“Until the BOJ moves towards more expeditious hikes or fiscal policy becomes more restrained, intervention alone is unlikely to deliver a lasting stabilization of inflation risk,” Goldman Sachs Group Inc. strategists including George Cole wrote in a note. “In our view, this leaves fiscal policy as the likely fastest policy route to boost both JGBs and JPY durably,” either through a narrower election result or a policy shift.