Dollar Swings Finally Start to Ripple Through Treasury Market

Sharp swings in the dollar are starting to seep into the Treasury bond market, a warning sign that a weak greenback has the potential to push interest rates higher.

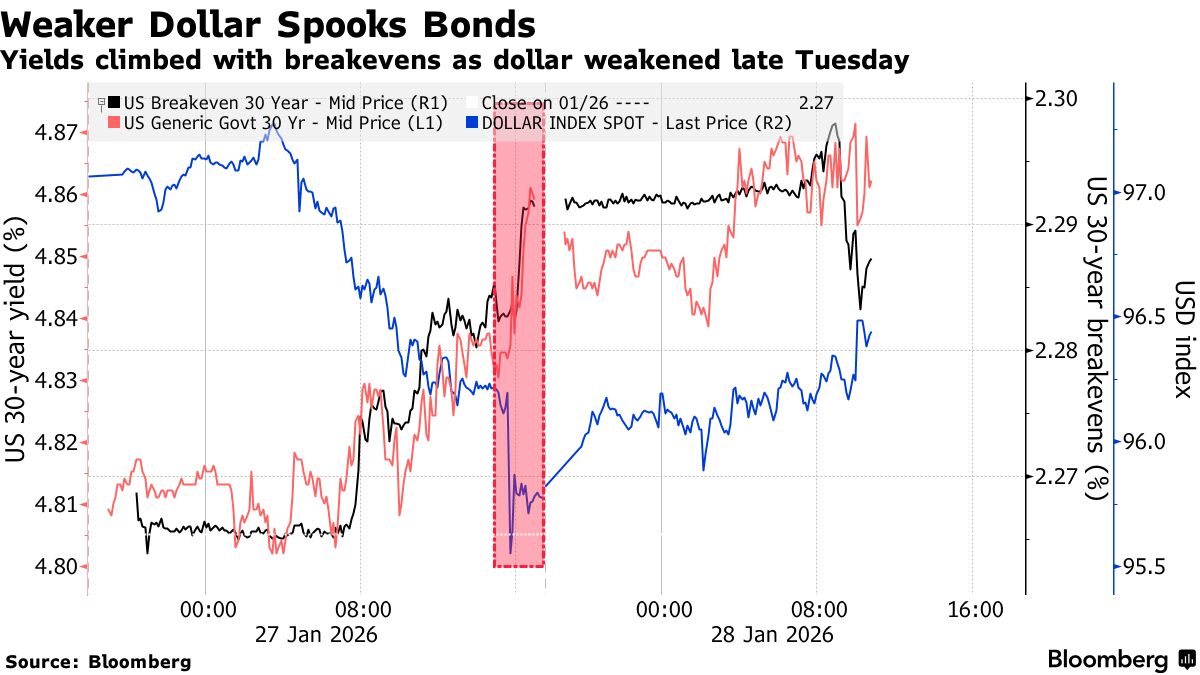

In late US trading on Tuesday and again Wednesday, swings in the value of the dollar drew reaction from the government bond market. That came in stark contrast to its indifference over the previous week as the Bloomberg dollar index fell more than 2.5% to the lowest level in nearly three years.

The dollar tumbled late Tuesday after US President Donald Trump said he with the currency’s decline, which was principally against the yen. It rallied on Wednesday after Treasury Secretary Scott Bessent denied that the US was acting on behalf of the Japanese currency.

Long-maturity Treasury yields rose sharply as the dollar fell, and they eased as the greenback later rebounded. The moves reflect the potential for currency devaluation to eventually become inflationary, an implicit rebuke to an administration that says it’s committed to lowering borrowing costs.

“The fate of the US bond market, especially the long-term sector, is tied to the dollar,” said George Goncalves , head of US macro strategy at MUFG Securities Americas Inc. “It is counterproductive if dollar weakness becomes inflationary” at a time when yields are high enough in countries including Japan to entice domestic investors.

Long-term inflation-protected Treasuries outperformed as yields rose, and trailed as they declined, another sign that the dollar moves were being viewed chiefly as a potential inflation catalyst.

In Tuesday’s dollar selloff, Treasuries cheapened relative to interest-rate swaps, an indication that bonds were being unloaded, and gauges of long-dated rates volatility picked up based on related options activity.

The yield increases were for now largely confined to long-maturity Treasuries, driving the 30-year about seven basis points higher relative to the two-year, the biggest increase in a day in several months. Still, sustained dollar weakness has the potential to erode foreign demand for Treasuries, about a third of which are held outside the US.