Currency Whiplash Is Fueling Bets on More Sharp Swings Ahead

In the global currency market, volatility has flickered back in a boon for traders after months of calm.

Currencies around the world have been hit with the biggest swings since last April, with the dollar sliding to a four-year low and the euro spiking to a five-year high last week. Now options markets are signaling that the volatility will persist in the months ahead, making a sharp break from the sleepy trading that dominated the second half of 2025.

That’s mostly down to unpredictable policymaking, from Donald Trump’s threats to attack Greenland to confusion about the direction for the Federal Reserve, which are in the greenback. The swings are a moneymaker for Wall Street banks that can reap higher transaction costs on volatile prices. Traders think it’s only so long before they’re in for another manic spell.

“With President Trump volatility can rise rapidly and tends to reverse the move faster as well,” said Sagar Sambrani , a senior FX options trader at Nomura International Plc in London. “It either goes from a completely stale regime, which we saw for the last six months, to potential mayhem and multiple barriers getting triggered.”

There’s certainly been no lack of action. A host of key levels have been breached, with the driving the pound to its highest since 2021 and the Swiss franc to its strongest since 2015. Japan’s yen bucked that trend ahead of a pivotal general election, nearing a four-decade low before swinging wildly.

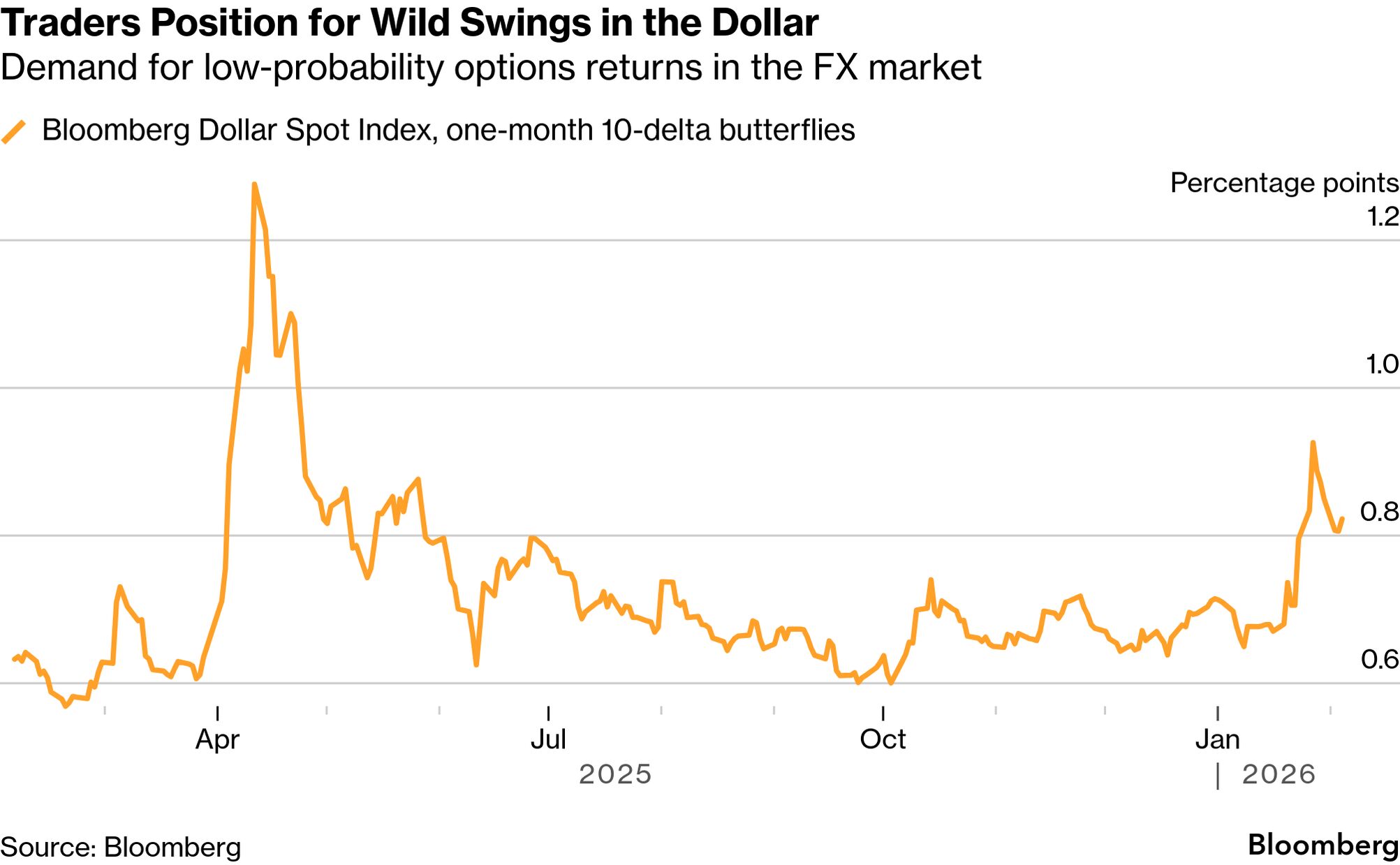

Options bets on big moves in the dollar are now at the highest since April, when Trump’s “Liberation Day” tariffs rocked global markets. The recent chaos in precious metals has also driven up gauges of future volatility in commodity currencies such as the Australian dollar and Norway’s krone.

That’s all fueling a turnaround for interest in trading Group-of-10 currencies. Big companies with foreign-exchange exposure are likely rushing to protect positions. And there’s more activity from hedge funds looking to profit from the fluctuations.

Read more:

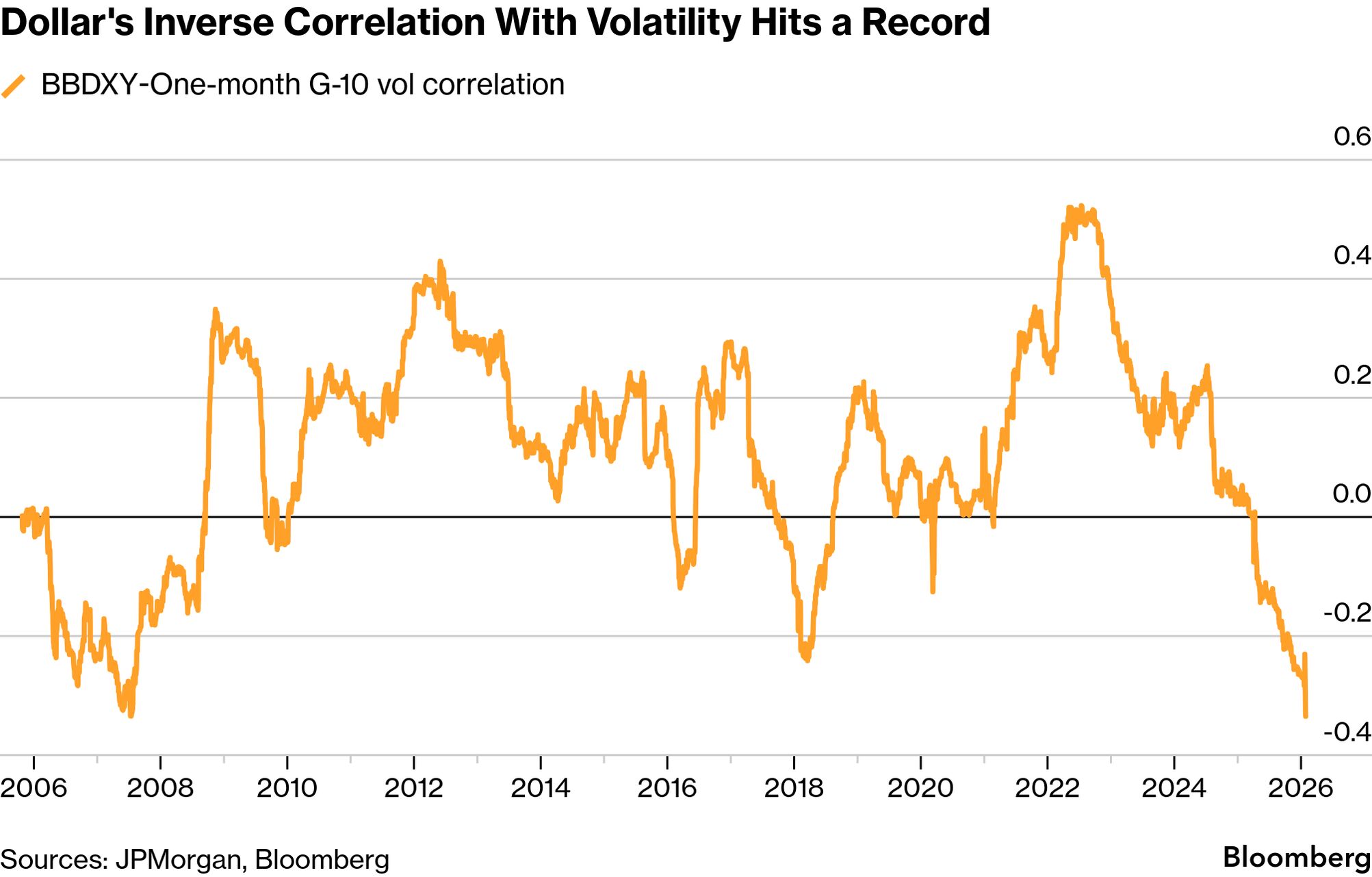

With the dollar no longer a reliable hedge against falls in risky assets — it traditionally strengthened in times of trouble — that also means investors need to look at alternatives. There’s now a record correlation between the weakening greenback and volatility, another sign bigger swings are on the way.

“We think the dollar has more room to sell off and we certainly expect more FX hedging,” said Julian Weiss , head of G-10 FX options trading at Bank of America Corp. “Gold-dollar was a more attractive trade than euro-dollar, but there’s now a renewed pressure to diversify again.”

Currency options revenue last year from the top 12 banks rose 30%, though this lagged the 50% annual growth seen in precious metals, according to data from Crisil Coalition Greenwich. While the in gold and silver — both denominated in dollars — is likely to keep them in focus, there are significant shifts underfoot in the outlook for the world’s reserve currency.

Trump’s apparent embrace of a weaker dollar is a turnaround from the usual US position of backing a stronger greenback. And after having called for steeper interest-rate cuts by the Fed, his nomination for a new central bank chief is now throwing on the outlook for US monetary policy.

Read more:

“For the first time since early last year, we are seeing a few themes emerge that have the potential to cause significant FX volatility,” said Tim Brooks , head of FX options trading at Optiver, an electronic market maker.

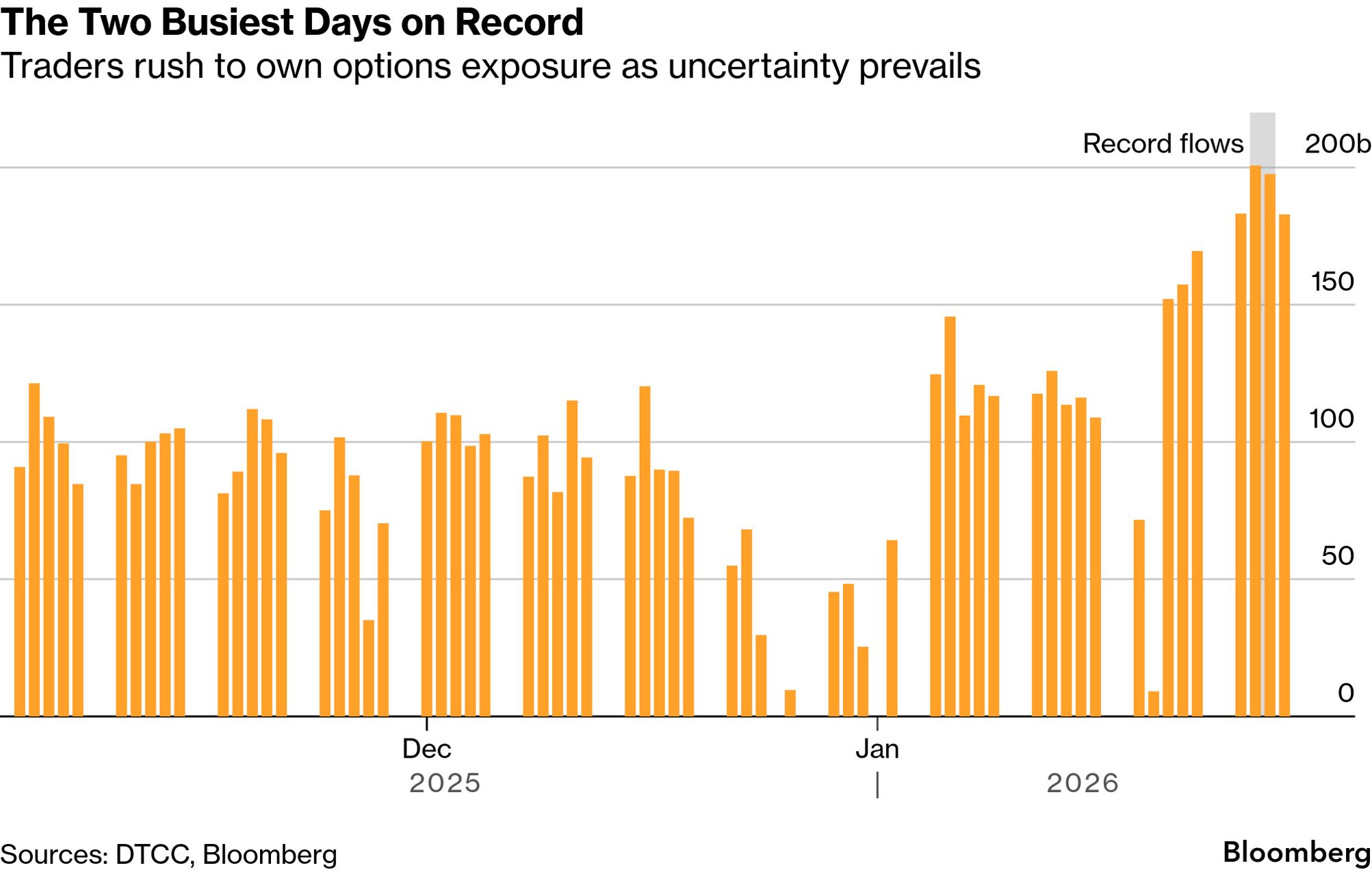

Optiver saw average daily trading volumes 80% higher in January compared to the second half of 2025. Data from the Depository Trust & Clearing Corporation also shows currency options markets had the two busiest days ever last week, reflecting the rush for hedges and speculative bets.

“I’m not surprised to see a refreshed urgency to own optionality,” said Eric Li , global head of FX trading at UBS Group AG, adding that clients have been particularly interested in positioning for the dollar to weaken against the euro and the yen.

Still, others say the jury is out on whether this greater trading volume and volatility can continue. There have been plenty of previous occasions where risk events have caused a flare-up, only for calm to return within months or even days.

“We have seen this movie before, and sudden breakouts rarely last,” said Tanvir Sandhu , chief global derivatives strategist at Bloomberg Intelligence. “FX volatility can stay suppressed amid macro uncertainty as conviction disappears.”

The revival in volatility this year follows a slump in December to the lowest level since the beginning of 2022. Some blamed that on a structural shift in the market’s most dominant players, rather than macro factors.

There’s been a rise of in so-called systematic strategies from hedge funds that consistently , making the market quicker to return to a sleepier status quo. These remain popular and risk dampening swings if realized volatility does not catch up with implied levels, according to UBS’s Li.

Read more:

For Andreas Koenig , head of global FX at Europe’s largest asset manager Amundi SA, the moves in currencies so far this year do justify forward measures of volatility being slightly more elevated.

“Volatility was too low. It should be a bit higher,” Koenig said.