Dollar Slide a Sign of Global Investor Hedging, Federated Says

The dollar’s slump this month in the face of steady US stock and bond markets suggests that global investors are raising their hedges against a weaker greenback rather than dumping American assets, says money manager .

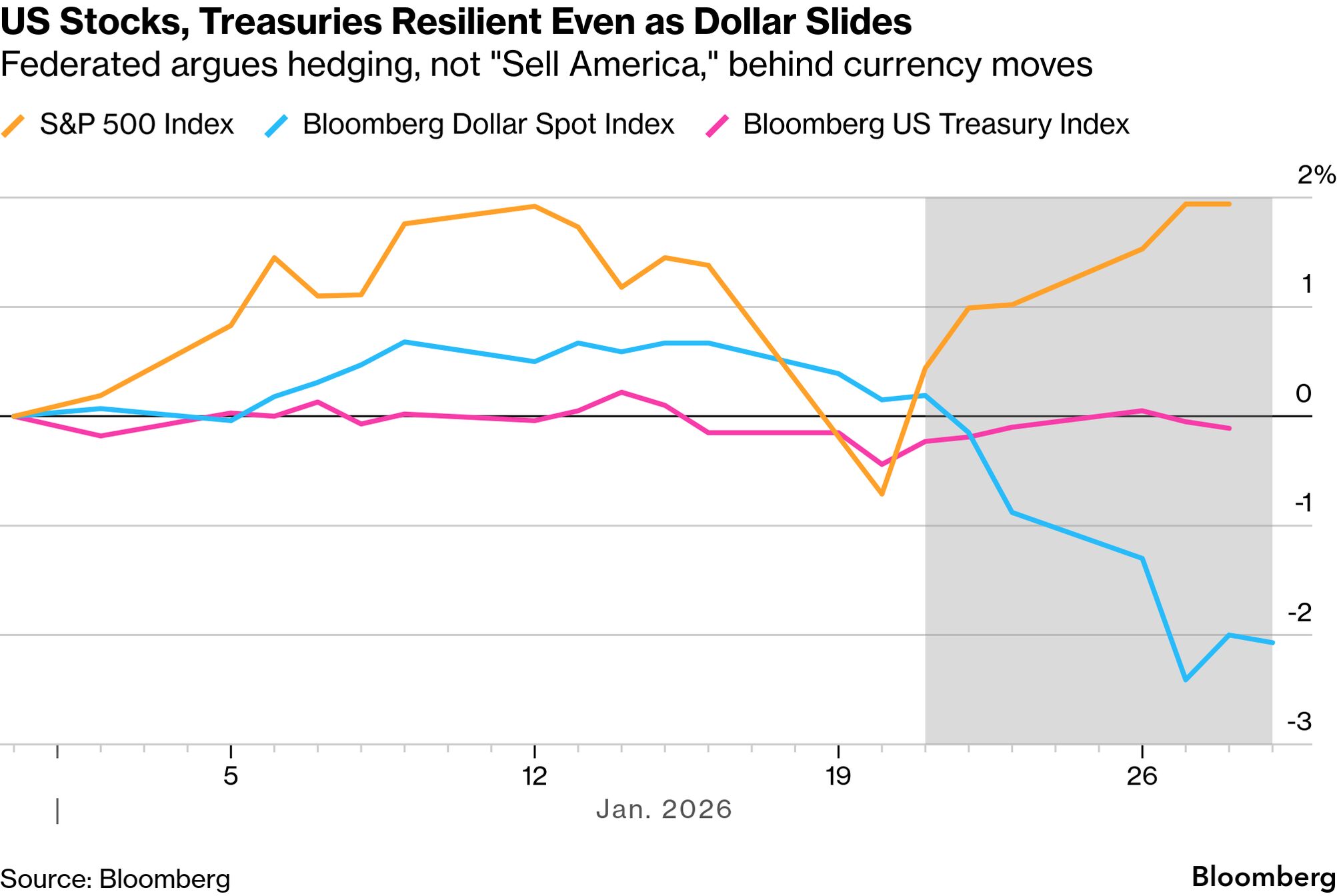

Bloomberg’s dollar gauge is down about 2% in January. The slide has been in part by worries around the risk of a renewed trade war over President Donald Trump’s push to acquire Greenland, and speculation about the potential for intervention to prop up the yen. The greenback is on track for its worst month since June and isn’t far above the lowest in almost four years.

“What foreign investors appear to be doing is hedging their American holdings rather than selling them outright,” John Sidawi , a senior portfolio manager for global fixed income at Federated Hermes, wrote in a report Thursday. “This has been one of our cornerstone considerations for our ongoing bearish outlook on the dollar.”

The Pennsylvania-based firm manages around $871 billion.

The S&P 500 Index is up about 2% to start the year amid solid corporate earnings, including among Big Tech names . Meanwhile, a Bloomberg tracking Treasuries on an unhedged basis is roughly flat, in line with other major sovereign-debt markets.

Read more:

The outlook for global investment in the US was a hot topic last year after Trump’s announcement of sweeping tariffs in April sparked a rout in American assets and the sharpest first-half selloff for the dollar since the 1970s.

Equities and Treasuries recovered but the dollar extended its losses. Some market watchers saying the divide was a result of investors buying derivatives to protect their purchases of US assets against further declines in the US currency.

At Federated Hermes, Sidawi expects that trend to continue and weigh on the dollar in 2026, ultimately raising deeper questions about the longer-term value of the world’s primary reserve currency.

“Should the weak dollar trend enter its second year, it could potentially indicate an erosion of the dollar’s long-held dominance,” he said.