Treasury Yields Rise on Expectations Warsh Will Be Fed Chair

Treasury yields pushed higher in Asian trading after US President Donald Trump said he would his nominee to chair the Federal Reserve on Friday morning.

US 10-year yields climbed three basis points and 30-year rates jumped five basis points after Trump said “a lot of people think this is somebody that could’ve been there a few years ago.” A rose as much as 0.3%.

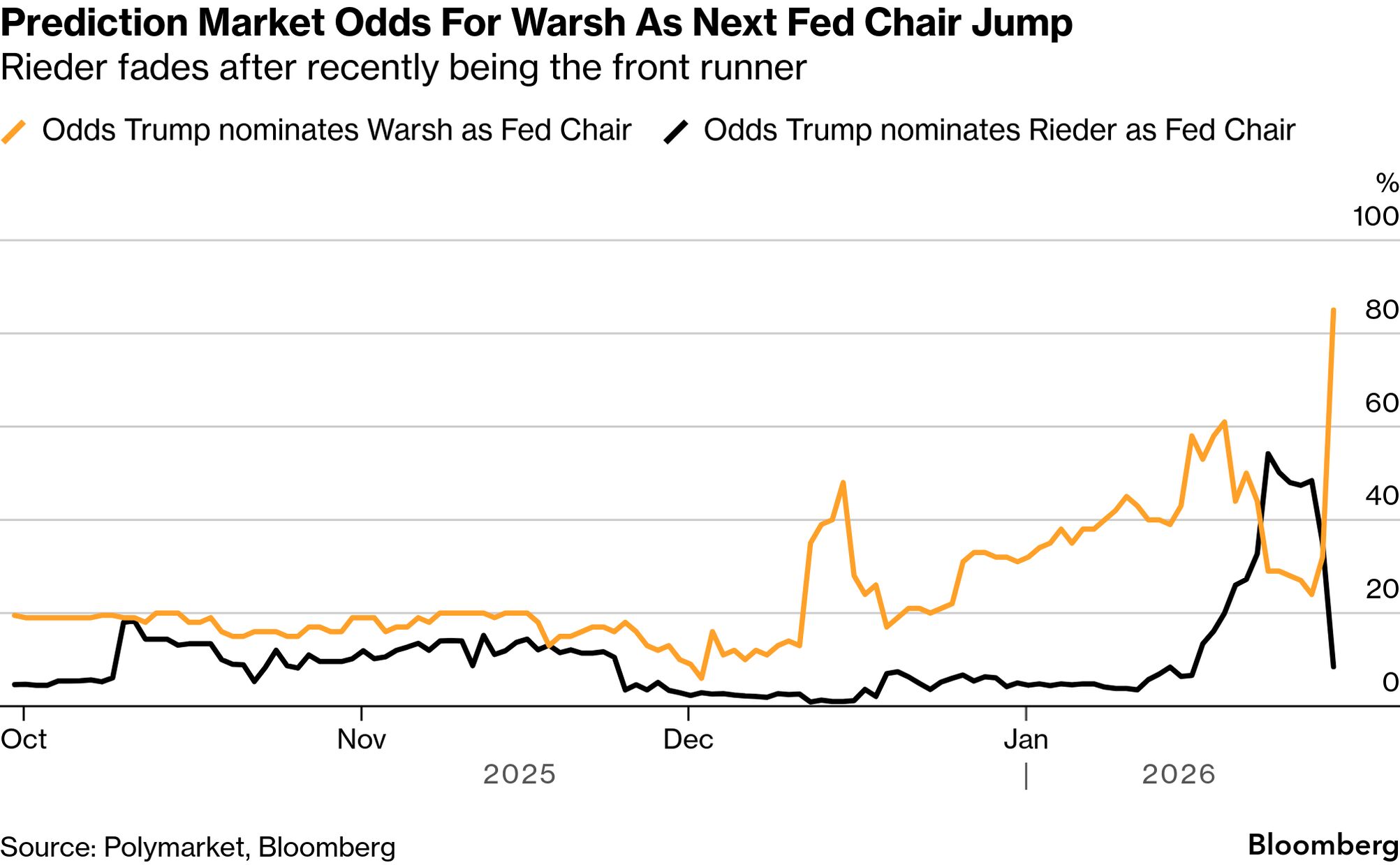

Betting markets are increasingly favoring former Fed governor Kevin Warsh , seen as a more hawkish contender, with Polymarket showing his odds of becoming the next Fed chair rising above 80% on Friday, as support faded for Rick Rieder .

“The market perception is that Kevin Warsh would be the relatively more traditional and less dovish option as Fed Chair, in which case we might see fewer rate cuts,” said Andrew Ticehurst , a senior strategist at Nomura Australia Ltd. in Sydney.

The predictions highlighted how sensitive rates markets have become to signals around the Fed’s leadership, with investors now positioning for a potentially more hawkish tilt at the central bank as the White House nears a decision.

Flows into interest-rate futures betting on a dovish policy shift had accelerated in recent days as Rieder’s odds moved to the top, with investors viewing him as more dovish than Warsh.

“Whatever he may say now, Warsh has a long hawkish history that markets have not forgotten, so the dollar and yields are higher,” said Sean Callow , a senior analyst at ITC Markets in Sydney.