Dollar Surges as Plunging Metals Hit Commodity Currencies

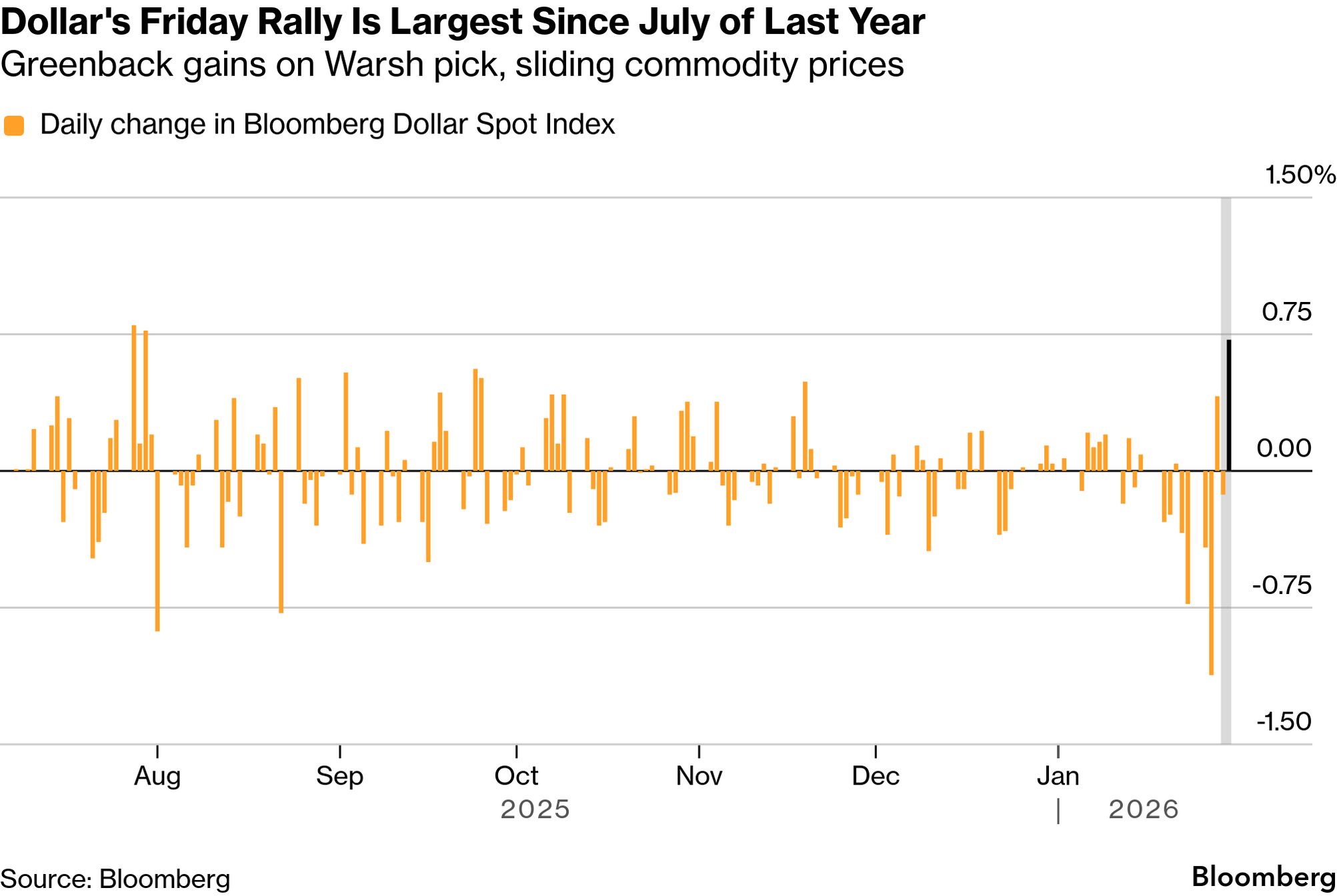

The dollar jumped, setting it up for its biggest one-day gain since July, as plunging gold and silver prices dragged down currencies from Australia to Sweden.

The rose as much as 0.9%, gaining against all major peers to end a wild month in which it has been whipsawed by President Donald Trump’s policies.

Friday’s rally, propelled by the slump in precious metals and Trump’s choice of Kevin Warsh to lead the Federal Reserve, still leaves the index about 1.4% lower in January, its worst month since August.

“Overall, markets are jittery,” said Kathleen Brooks , research director at XTB. “The dollar debasement trade has been put on hold for now, this does not mean that it is over.”

The Australian dollar, Swiss franc and Swedish krona — which are affected by the prices of precious metals — led the selloff among Group of 10 currencies. Silver prices suffered the biggest intraday drop on record, while gold prices declined the most the early 1980s, halting a rally.

The moves took hold early Friday after Trump announced he would nominate Warsh to succeed Jerome Powell at the Fed. Traders see Warsh as more inclined than other finalists for the post to guard against rising price pressures, a stance that may translate into monetary policy supportive of the dollar.

Read more: