Rand Rebound Sets Stage for Rally to Resume as Metals Stabilize

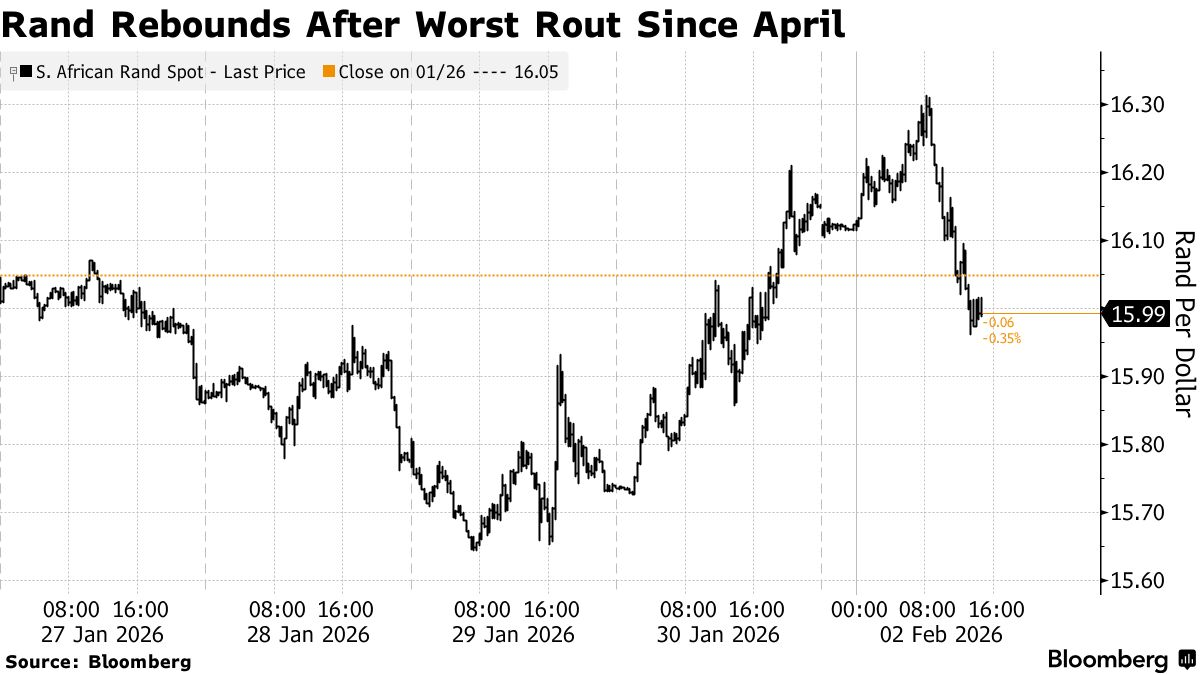

South Africa’s rand rebounded on Monday after the worst selloff since the tariff turmoil in April, and investors see the currency resuming gains that have made it one of the best performers among emerging-market peers over the past year.

The rand climbed as much as 1.3% against the dollar as metals and equities clawed back losses. The factors that supported the rally — a credible central bank, a stable governing coalition, favorable terms of trade and high real interest rates — remain in place, according to strategists including Deutsche Bank AG’s Christian Wietoska .

“We are not changing our structural views because of a minor near-term correction,” Wietoska said, adding that he sees “nothing in the way of keeping a bullish stance.”

The rand plunged 2.6% on Friday as the price of gold plummeted along with silver and platinum, raising concern that a commodities-fueled rally in South African assets may be coming to an end. But the correction provided an opportunity to buy the currency at cheaper levels, according to Hironori Sannami , a foreign-exchange trader at Mizuho Bank in London.

“As the metals market stabilizes, I expect the rand to see buybacks,” Sannami said. The rand, often used as a proxy for emerging-market assets, sold off in tandem with precious metals but “the stability of rand carry trades hasn’t been shaken,” he said, referring to the strategy of borrowing in low-yielding currencies to buy high-yielding assets.

Read more:

The rand was 0.5% stronger at 16.0721 per dollar by 3:36 p.m. in Johannesburg, bringing its gain this year to 3.1%.

Government bonds have been relatively resilient to the selloff, with the yield on 2035 rand securities steady at around 8.02% after rising six basis points on Friday. There is room for further gains after a rally that had driven benchmark yields to two-decade lows last week, according to Kristof Kruger , a senior fixed-income trader at Prescient Securities.

“We still see value, but we’re favoring measured exposure rather than chasing duration aggressively after the rally,” Kruger said.