Investors Rush to Join Asia’s AI Boom as Global Markets Whipsaw

In what is shaping up to be another blockbuster year, Asia’s markets are outpacing peers in the US and Europe, drawing global investors as rattle assets from tech stocks to .

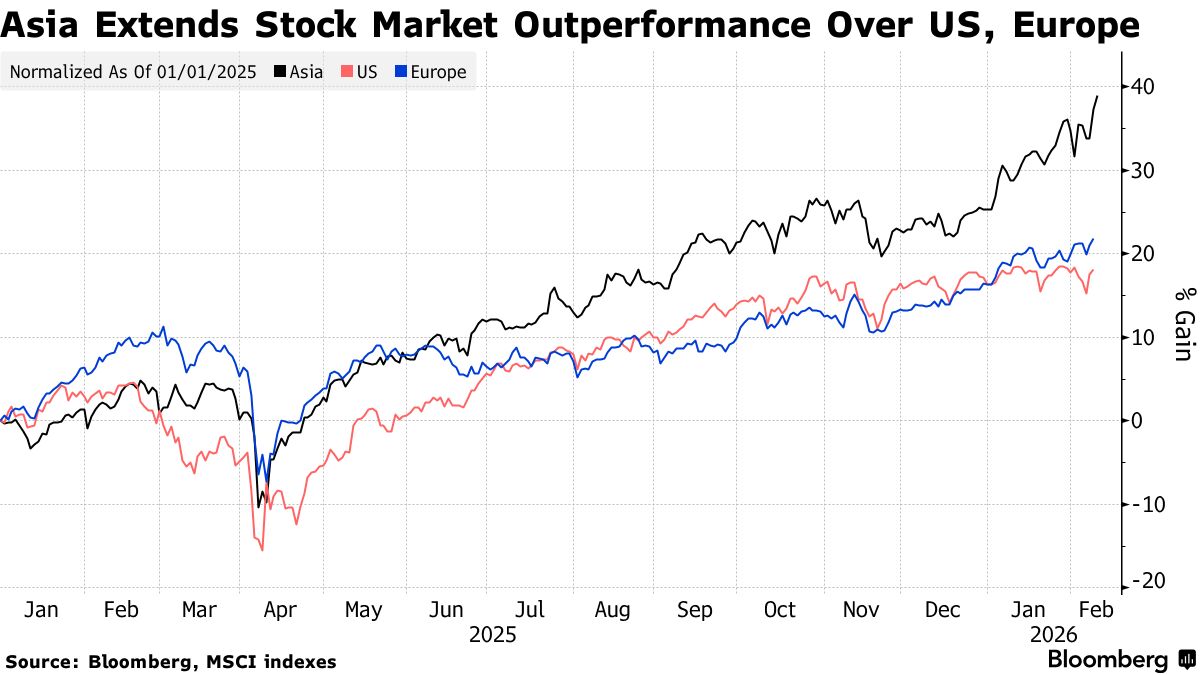

Most equity benchmarks in the region have risen in 2026, currencies have shown resilience against external pressures, and demand for credit has pushed spreads to near record lows. While it’s still early days, and Asia hasn’t been immune to the global volatility, the region has several forces working in its favor.

Its biggest tech firms are cementing their to the artificial intelligence supply chain, while countries from South Korea to Japan are taking steps to boost . A robust — reinforced by — is adding to the allure, with the International Monetary Fund projecting that Asia will contribute around 60% of global growth this year.

“Asia is really at a crossroad of three big thematics,” Aidan Yao , senior investment strategist for Asia at Amundi Investment Institute, said in a Bloomberg Television interview on Tuesday. The first is AI, second is a corporate reform story in many markets, and the third is improving fundamentals, he added.

Asia’s strength stands out when investors’ convictions in everything from tech stocks to precious metals and are being tested by for US interest rates and uncertainty over AI-driven .

It climbed 7.5% in January — the best monthly advance since 2023 — and has extended gains to hit a fresh record on Tuesday. The moves compound a in 2025 and are helping the regional gauge outperform the S&P 500 Index as well as the STOXX Europe 600 Index.

Leading the charge are the tech-heavy markets of South Korea and Taiwan, as well as Japan — where optimism is after Prime Minister Sanae Takaichi’s party just achieved the biggest post-war victory for a single party in a general election.

Asia is winning favor with investors as the global tech race is shifting from AI pioneers to the enablers of large-scale adoption. Regional firms control critical choke points — from advanced chips and memory to foundry services and assembly — supplying much of the hardware underpinning the AI build-out.

“We’ve been positive on Korea and remain so. We’re overweight — it’s one of our top markets,” Timothy Moe , chief Asia Pacific equity strategist for Goldman Sachs Group Inc., said on Bloomberg Television. “A significant part of it is this memory supercycle that we’re in which has very positive effects.”

The greenback’s persistent decline provides another tailwind by easing pressure on Asian currencies and lowering the cost of servicing dollar-denominated debt. It’s also positive for emerging economies that rely heavily on imports priced in the currency.

The fell in five of the last six months thanks to the so-called — wherein investors flocked to gold, silver and other precious metals, seeking a store of value to withstand a downswing in currency and bond markets as public finances deteriorate. Late in January, the gauge slid to its lowest level since 2022 as President Donald Trump indicated he was the currency’s decline.

An of Asian currencies is up another 0.6% in 2026 after rising more than 3% last year — its first annual advance in five years.

“A weaker US dollar is both a cause and a symptom of Asia’s outperformance,” said Kyle Rodda , senior financial market analyst at Capital.com. “The dollar would be higher if it weren’t for the political risk premium – the “sell America” trade – discounted into the currency.”

That said, risks remain. And with sentiment firmly bullish, the margin for error is narrowing.

Any disappointment in chip demand or pricing power would ripple across markets given that stocks are high earnings expectations. More broadly, while effective US tariffs turned out to be lower than the initial announcements for most Asian economies, further escalation of trade tensions is a key concern, according to the IMF.

And, a looming change of guard at the Federal Reserve is adding to policy uncertainty. Wall Street investors and strategists last month that Trump’s pick of Kevin Warsh to lead the Fed is a relatively hawkish choice, which will support the dollar and a steeper Treasury yield curve.

“If the Trump administration maintains more stable trade and foreign policy, the dollar should recover a bit,” said Rodda. “This could tighten financial conditions in Asia and potentially lean against upside in the region’s stocks.”

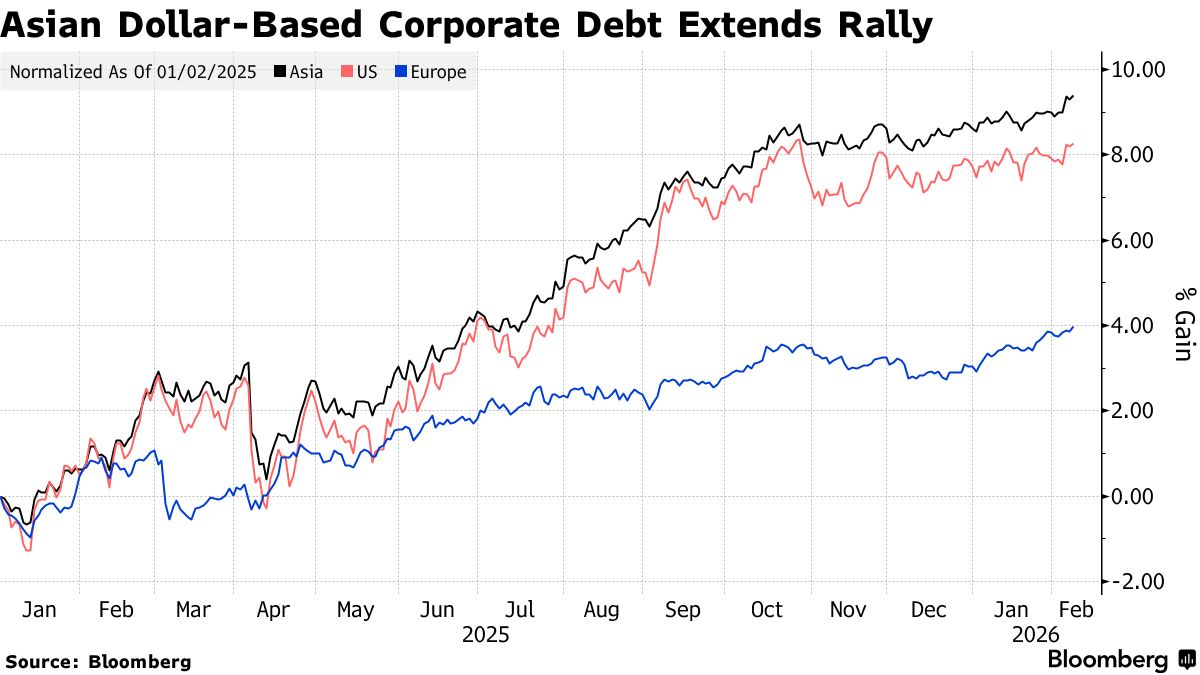

For now though, Asia’s credit markets too are going from strength to strength, and the AI trade has had a role to play here as well. Just as US chip demand is lifting Asian stocks, the AI build-out is tightening investment-grade credit spreads as investors favor high-quality issuers with durable cash flows and long order books.

A measure of Asian dollar-based investment grade credit has outperformed its and European counterparts in recent months.

Global fixed income investors are showing signs of concerns about the scale of investment needed and levels of corporate debt issuance from so-called “hyperscaler” companies, according to Amy Xie Patrick , head of income strategies for Pendal Group Ltd . in Sydney.

“Over 50% of hyperscaler capex this year is expected to be funded from US investment grade issuance,” Patrick said, adding that worries about the rising issuance could spur a rotation away from US investment grade credit into corporate debt in markets .

Read more: