Hedge Funds Revive Yen-Weakness Trades Ahead of Japan Vote

Hedge funds are reviving bets against the yen , positioning for renewed weakness as Japan heads into a pivotal election this weekend.

Dollar-yen returned to the spotlight after Prime Minister Sanae Takaichi pointed to the of a weaker currency ahead of the Feb. 8 vote. She called the snap election to consolidate her leadership, with polls showing her party on track for a standalone majority — a result that could give her greater latitude to pursue fiscal stimulus and add to Japan’s already heavy debt load.

Options markets are reflecting the shift. Trading volume in dollar-yen call options worth $100 million or more, which gain if the pair rises, exceeded that of equivalent put options on Tuesday, according to data from the Depository Trust & Clearing Corporation. Amid a pickup in call option demand, the premium to hedge dollar-yen’s downside compared to upside over the next month has fallen to its lowest in nearly two weeks.

“Now that markets have stabilised a little and the extreme froth in the precious metals market has calmed down, there is a growing move back into carry and Takaichi trades by hedge funds,” said Antony Foster , head of G-10 spot trading at Nomura International Plc in London. “The Japanese election is this weekend and the feeling that higher levels in USD/JPY will be seen is back, especially if Takaichi wins big.”

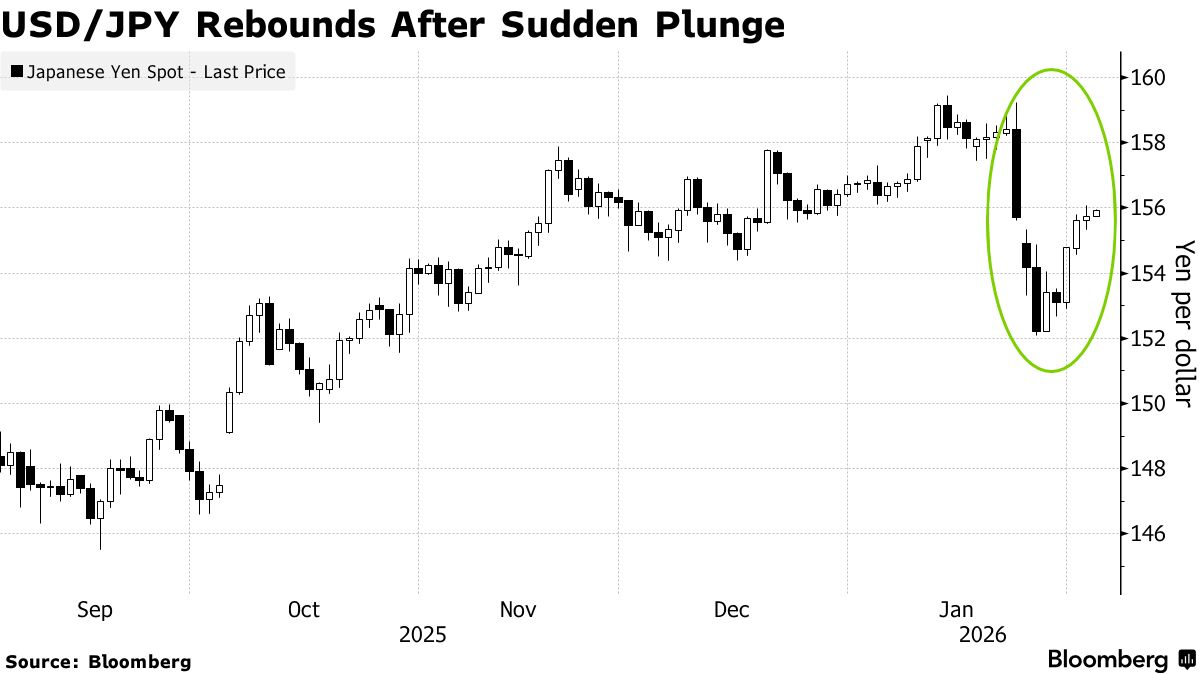

The yen slid steadily after Takaichi secured the leadership of the Liberal Democratic Party in October, hitting an 18-month low against the dollar last month. The move reversed sharply after a dollar-yen by the Federal Reserve Bank of New York on Jan. 23, reinforced by from President Donald Trump days later. Pressure on the currency, however, soon resumed after Treasury Secretary Scott Bessent support for a strong-dollar policy and Kevin Warsh was nominated as the next Federal Reserve chair.

Takaichi’s latest remarks have added to the renewed bullishness in dollar-yen.

“Remarks over the past weekend highlighting the benefits of a softer JPY for exporters appear to have sparked renewed interest in USD/JPY buying,” said Mukund Daga , global head of FX options at Barclays Bank Plc.

Asset managers, often referred to as real money funds, by contrast are taking a more cautious stance amid recent volatility as they wait for greater clarity on where the pair is next headed.

“Real money is largely sidelined, using options for protection rather than committing to a clear USD/JPY direction,” said Ivan Stamenovic , head of Asia-Pacific G-10 currency trading at Bank of America Corp.