Hedge Funds Ramp Up Bearish Pound Option Bets on Starmer and BOE

The British pound has been hit by a one-two punch in recent days, and it may come under further pressure as hedge funds boost bearish bets against the currency in the options market.

The positioning comes as the sterling fell to the lowest in two weeks versus the euro and the dollar on Feb. 5 — the day the Bank of England came within one vote of . The pound was dealt another blow as a involving UK Prime Minister Keir Starmer ’s leadership deepened after his chief of staff quit over the appointment of Peter Mandelson as ambassador to Washington.

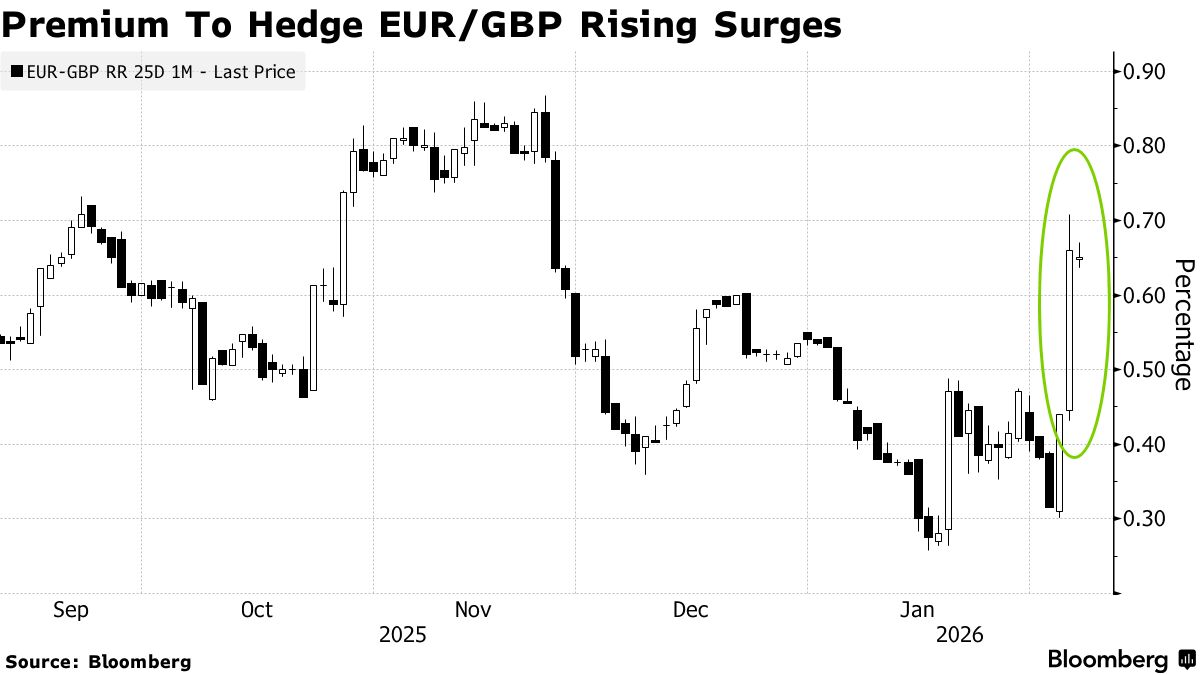

The premium to hedge sterling’s drop versus the euro over the next month, compared to a gain, jumped to its highest since late November on Feb. 5. Trading volume of euro-sterling options climbed to the year’s high the same day, according to data from The Depository Trust and Clearing Corp. The volume of call options, which gain if sterling weakens versus the euro, was 50% larger than that of put options, which increase in value if the pound rises.

Hedge fund flows into “euro-pound remained one‑way, with heavy topside buying,” said Thomas Bureau, global head of FX option trading at Societe Generale, referring to demand for call options following the market moves on Feb. 5. “The pound has traded with EM‑style volatility, driven by global dollar strength and hypersensitivity to geopolitical headlines.”

The latest developments are a further setback for the pound after it weakened more than 5% versus the euro last year. at Goldman Sachs Group Inc. see sterling weakening 6% against the euro in 12 months while Nomura Holdings Inc. expects a decline of 3% by end-April.

Sterling was already under pressure before the BOE decision given that Starmer’s position as the UK’s leader was looking increasingly tenuous, according to RBC Capital Markets.

“In particular, we saw demand for EUR/GBP topside,” said Jamie Sanders , London-based director of foreign-exchange options trading at RBC. That demand led the pair’s implied volatility, a measure of expected price swings, to reprice “much higher,” he added.

Jane Foley , FX strategist at Rabobank, sees a risk of euro-pound edging higher heading into the middle of the year and cable moving lower, assuming the dollar avoids another sharp selloff. Starmer had been expected to face a challenge to his leadership after the local elections in May but that may now happen earlier, she added.

“The market will be very wary of UK political jitters particularly if it starts to look likely that the next PM may come from the left wing of the Labour party,” Foley said.

But sterling’s advance versus both the euro and dollar on Friday suggests that its path lower may not be a straight line. US payrolls and inflation data are likely to be near-term event risks, with political headlines expected to remain a key driver.