State Street’s Ferridge Sees 10% Dollar Drop on Three Fed Cuts

The dollar may fall 10% this year as there’s a risk the Federal Reserve will cut interest rates more deeply than markets anticipate once the next chair of the central bank takes over, according to State Street Corp.’s Lee Ferridge .

Traders expect that the Fed will resume lowering interest rates around June and deliver at least two quarter-point reductions by year-end. But Ferridge, a strategist at the bank, sees scope for officials to deliver a third reduction in 2026. That’s in part on the view that current Chair Jerome Powell ’s successor will face pressure from President Donald Trump to reduce borrowing costs.

“Three is possible,” Ferridge said in an interview on the sidelines of the TradeTech FX conference in Miami. “Two is a reasonable base case, but we have to accept we are going into a more uncertain period of Fed policy.”

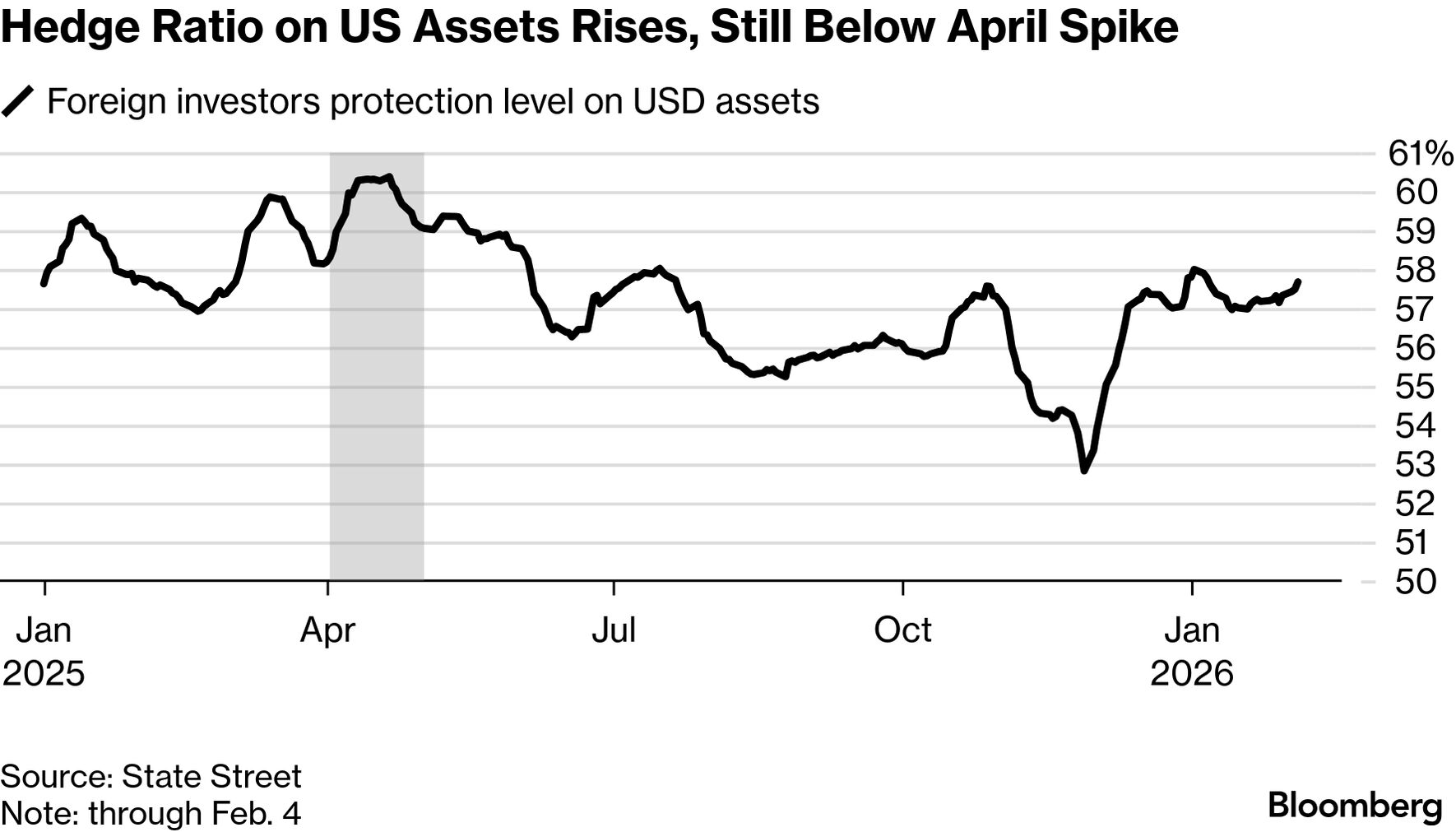

The other dynamic is that deeper Fed rate cuts will make it less expensive for foreigners to hedge the currency risk on their US investments, and as they step up that activity it will weigh on the greenback, he said.

The Bloomberg Dollar Spot is down about 1.7% this year after sliding roughly 8% last year, its worst annual performance since 2017.

Concerns around the economic impact of trade friction and worries around the US fiscal outlook hurt the greenback, as did Trump’s pressure on the Fed. Trump has nominated former Fed Governor Kevin Warsh to succeed Powell, whose term ends in May, and Warsh, if confirmed, may deliver what Trump wants, Ferridge said.

The greenback may rebound 2%-3% in the near term as solid US economic data reduces expectations for Fed cuts, Ferridge said.

However, dollar selling is “just waiting for once Kevin Warsh takes over the Fed and starts cutting rates probably more persistently and narrowing that rate spread with the rest of the world,” Ferridge said. “If that happens then we know there’s room for that hedge ratio to rise.”

The present hedge ratio of about 58% compares with a level of above 78% back before the Fed started hiking rates in 2022, State Street data show.