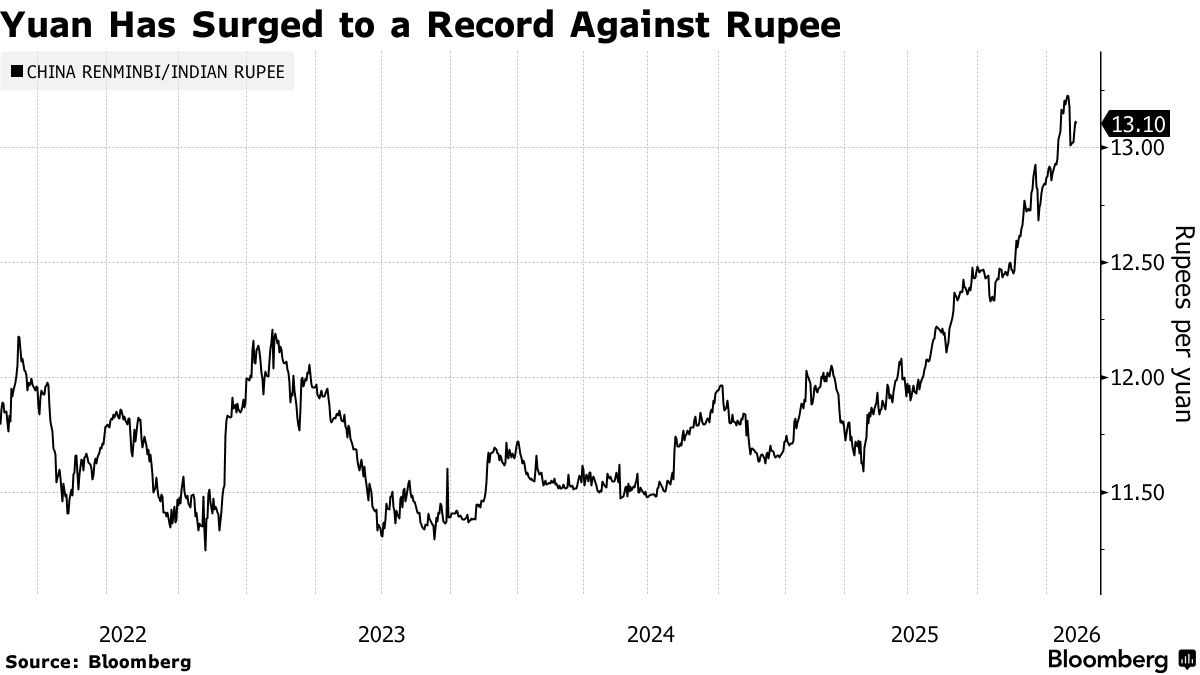

Yuan Poised to Extend Surge Against Indian Rupee, Analysts Say

The yuan’s rally against the rupee may have further to run, as authorities in India and China diverge in how they manage their currencies, according to analysts.

Australia and New Zealand Banking Group Ltd. sees the rupee weakening to 13.58 per yuan by the year-end. expects the pair to move toward 13.30 by December, while sees it hitting that level in three to six months.

The yuan’s moves matter for India as China is its largest source of imports and their bilateral trade continues to expand. Further strength in the yuan, which climbed to a record against the rupee last month, will raise the cost of Chinese goods for Indian importers. This may potentially alter trade dynamics and impact inflation just as the Indian central bank nears the end of its rate-cut cycle.

“I expect the yuan to continue to appreciate as the authorities look favorably toward having a stronger currency,” said Khoon Goh , head of Asia research at ANZ in Singapore. For India, the need to have a more competitive currency to offset its “higher relative inflation rate to other Asian economies means the rupee’s nominal exchange rate needs to weaken further.”

India’s retail is on an upward trajectory, while China has seen bouts of consumer-price . The widening price gap between the two economies will increase pressure on the rupee to adjust to keep Indian exports , particularly if the yuan’s gains begin to slow.

The yuan surged nearly 10% against the rupee last year, the most in 12 years. It benefited from a surge in capital inflows , dollar weakness and the People’s Bank of China’s higher tolerance for a stronger currency. In contrast, the rupee hit successive lows against the dollar on foreign outflows, before erasing some of the losses after India-US trade deal.

While a spate of Wall Street banks, including Bank of America Corp., Goldman Sachs Group Inc. and Morgan Stanley, have raised their for the yuan, the outlook for the rupee isn’t that bright.

“We see limited room for the rupee to run from the current levels,” Goldman Sachs analysts including Santanu Sengupta wrote in a note. Any pick up in portfolio inflows on the India-US trade deal “is likely to be met with a gradual unwind of the short forward book, and further build-up of FX reserves by the Reserve Bank of India.”

Read More:

Some strategists, including at Bank of America Corp., see the yuan’s rally against the rupee plateauing as the Indian currency’s weakness has pushed it into undervalued territory on a real-effective-exchange-rate basis. The pair was trading at 13.14 as of Thursday evening.

The yuan’s surge comes at a time when both the countries are trying to economic ties after a deadly border clash in 2020 strained their relations. India’s trade deficit with China widened to a record $116 billion in 2025, according to China’s customs data, the most among the former’s trading partners.

“The yuan remains materially undervalued after years of price deflation. It could steadily appreciate ahead and outperform the rupee in coming months,” said Madhavi Arora , an economist with Emkay. She sees the yuan-rupee pair “as an important metric for the rupee’s adjustment in coming years, given India’s trade imbalances with China.”