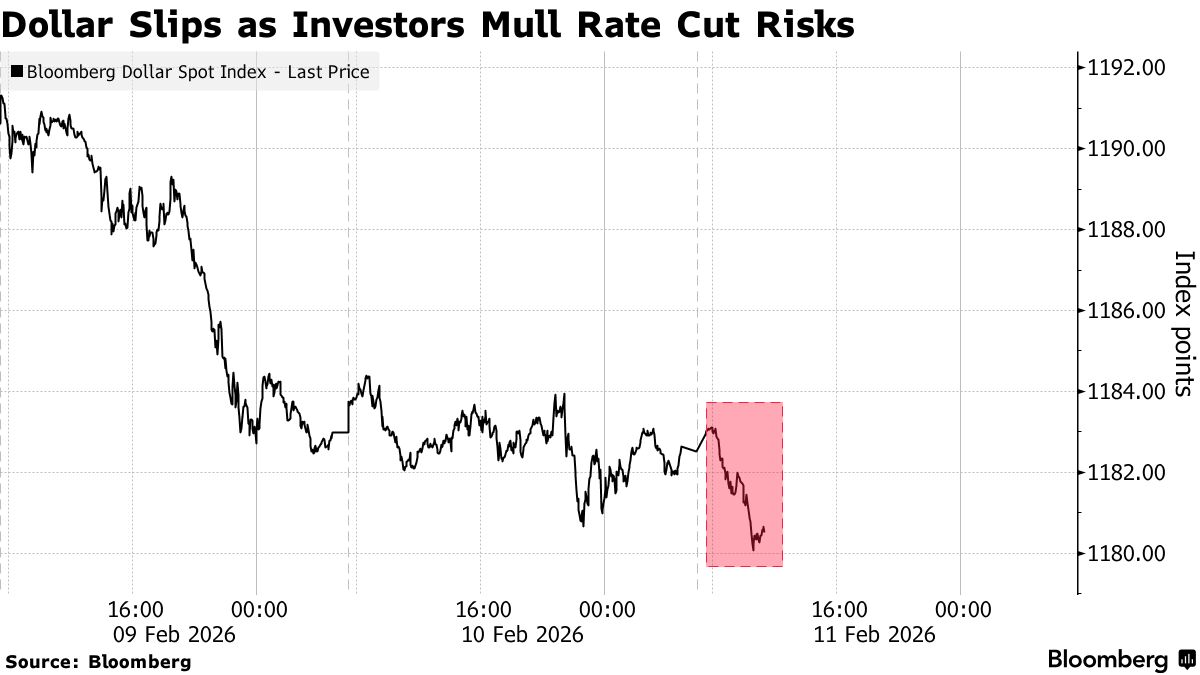

Dollar Weakens Before Payrolls as Traders Mull Rate-Cut Risks

The dollar dropped against all of its major peers as investors ramped up bets on Federal Reserve interest-rate cuts following fresh signs of weakness in the US economy.

Bloomberg’s of the US currency fell for a fourth day as Asian investors weighed how softer-than-forecast retail sales data published Tuesday backed the case for more Fed rate reductions. Concern ahead of US payrolls data due Wednesday and inflation numbers on Friday are giving traders further reason to trim dollar positions.

“The relative rates story is back in play with soft US economic data encouraging investors to price in greater chance of further Fed rate cuts,” said David Forrester , a strategist at Credit Agricole in Singapore.

US retail sales in December, Commerce Department data showed Tuesday, indicating consumers provided less support for the economy as the year drew to a close.

Australia’s dollar led gains versus the greenback after central bank Deputy Governor Andrew Hauser said inflation is still “ ,” paving the way for more rate hikes. The yen strengthened for a third day after Prime Minister Sanae Takaichi’s election victory on the weekend.

“The yen remains one of the Group-of-10 currencies the most sensitive to relative rates, and is receiving the additional boost of the long end of the Japan government bond curve being well behaved post the Lower House election,” Credit Agricole’s Forrester said.

Hedge funds positioned for the US payroll data by buying dollar-yen option structures that will gain in value if the pair keeps dropping. They also the purchased the Aussie against the greenback in spot markets.

US employers probably added 65,000 workers in January, according to a Bloomberg survey of economists, an outcome that would the biggest job gain in four months.

“Non-farm payrolls tonight then CPI will be important to see if this rate divergence holds,” said Calvin Yeoh , a fund manager at hedge fund Blue Edge Advisors Pte in Singapore, who has bullish positions on the yen.