China Economists Urge Looser Capital Controls as Dollar Wobbles

Several prominent Chinese economists have called for loosening restrictions on the movement of money in and out of the country , arguing that a weaker dollar provides a historic opportunity to boost the yuan ’s global appeal by increasing its convertibility.

In what would represent a tectonic policy shift for the world’s No. 2 economy, Miao Yanliang — chief strategist at China International Capital Corp. — said in an Tuesday that conditions are becoming ripe to push for such reforms without necessarily provoking massive capital outflows.

Echoing that view, Ju Jiandong , a finance professor at Tsinghua University, identified this year and next as a “strategic window” for opening up the so-called capital account because the yuan’s appreciation provides a favorable environment while geopolitical risks rise.

“The more China opens its capital account and allows greater exchange rate flexibility, the more it can actually attract capital inflows,” said Miao, formerly the chief economist at China’s foreign-exchange regulator. “Especially when the dollar enters a strategic and sustained depreciation cycle and the yuan enters an appreciation cycle, that is precisely the right time to raise the level of capital account openness.”

The remarks follow comments by President Xi Jinping — delivered in 2024 but published recently — in which he to make the yuan “widely used” in global trade and finance as well as attaining reserve currency status.

The quick succession of speeches and publications in recent weeks will add to speculation that Chinese authorities could make a much freer flow of capital the centerpiece of their efforts to promote broader international use of the yuan. Progress toward a convertible currency was disrupted by a shock devaluation in 2015, and momentum behind discussions of reforming the capital account waned in recent years.

But for the first time in a decade, influential voices in academia and finance are publicly broaching the possibility of ceding more control to seize the chance provided by misgivings over the dollar’s dominance that are driving diversification needs for central banks and investors alike.

The dollar ended 2025 with the sharpest annual retreat in eight years after months of unpredictable policymaking during Donald Trump ’s second presidency. By contrast, the yuan had its best annual performance since 2020 in nominal terms.

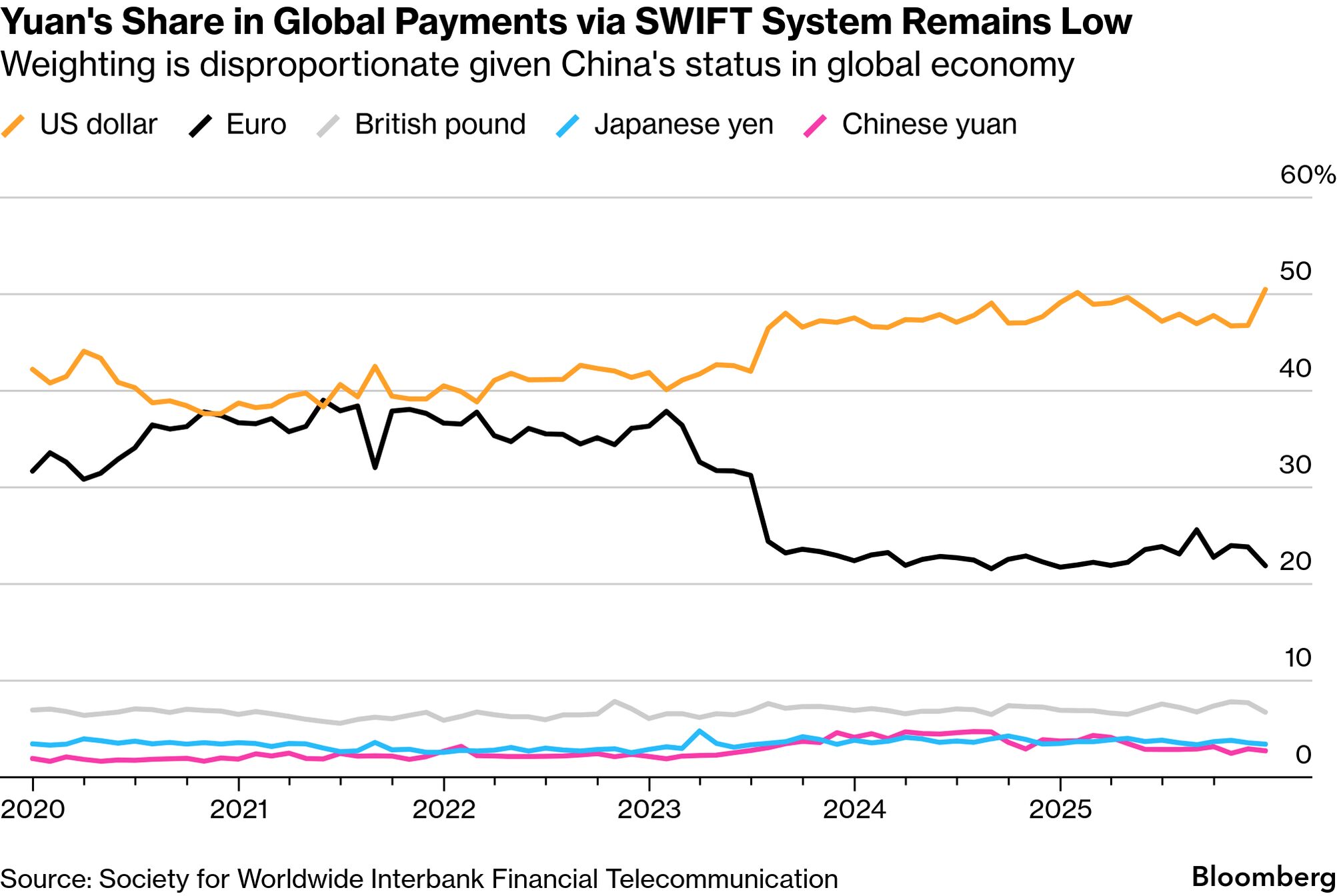

A key part of the new calculus for China also stems from the mismatch between its standing as a global manufacturing powerhouse and the limited reach of its currency abroad. China has for years maintained a “ ” of the yuan, while existing restrictions on cross-border investments and personal remittances mean the capital account remains largely closed.

For months, officials have been signaling a greater ambition of reforming the yuan and the capital account, which tracks investment flows.

The Communist Party’s October proposal for its next economic plan through 2030 included a pledge to “push forward the internationalization of the yuan and enhance the openness of the capital account.” That’s a bolder stance compared with the previous five-year plan, which called for promoting the currency’s globalization in a “stable and prudent” manner.

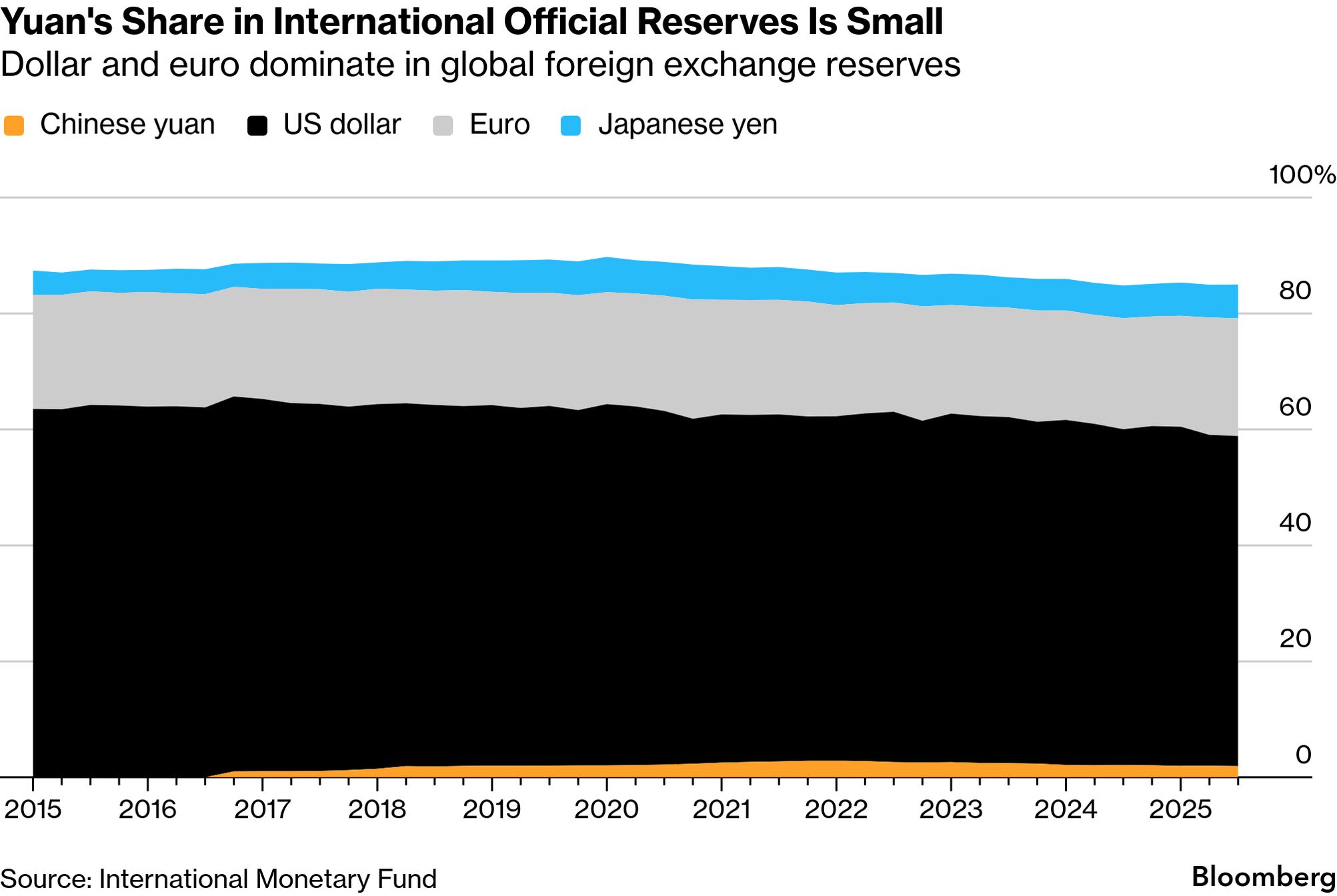

China has a long way to go to accomplish its goal. Despite gaining a bigger role in trade settlement and financing, the in global international reserves is less than 2%, according to the International Monetary Fund, lagging in a distant sixth place and remaining far behind the dollar.

Capital controls remain the biggest obstacle to Xi’s vision, even though China has taken steps in recent years to relax the restrictions. Investors and companies still need permission to move money in and out of the country or have to rely on designated channels, preventing domestic markets from being more integrated with the outside world and limiting the currency’s appeal.

The threat of large capital outflows that risk destabilizing markets and the economy is the biggest concern for authorities as they explore bolder liberalization.

China last experienced significant capital flight in 2015 after a botched move to shift to a more market-based exchange rate triggered panic among investors and forced the central bank to intervene. China’s foreign reserves plunged by around $1 trillion yuan within the span of about two years, prompting authorities to tighten capital controls.

But the environment both at home and overseas has changed significantly from a decade ago, according to Miao.

He said foreign investors have a growing need to invest in Chinese assets as the appeal of the US suffers from Trump’s drastic tariffs and geopolitical maneuvering. Meanwhile, Chinese households and companies have already a sizable amount of assets overseas via approved channels, reducing potential outflow pressures, Miao said.

Li Xunlei , chief economist at Zhongtai Financial International Ltd. who attended an economic seminar hosted by Premier Li Qiang in April, made a similar point in an published last week.

The Chinese currency’s significant undervaluation — based on actual purchasing power — results from a lack of global liquidity, he said. A more open capital account could boost the availability of yuan internationally, a change that will likely help the currency appreciate, according to Li.

To be sure, after treading carefully for decades, Chinese authorities are likely to remain cautious and be in no rush to roll out any big changes.

“There could be some room on a marginal basis to experiment with certain policy,” said Gary Ng , senior economist at Natixis SA. China could still take modest steps to promote its currency, such as pushing for some commodities to be traded in the yuan or using it to settle and finance investments in overseas projects, he said.

Xiao Sheng, an official with the State Administration of Foreign Exchange, signaled the focus will likely be on optimizing existing channels of cross-border investment.

In an article published Wednesday, Xiao said the regulator will make it more convenient for foreigners to use programs such as the Qualified Foreign Institutional Investor system. Authorities will “step up the supply of policies to expedite cross-border investment and financing,” he said.