Companies Ramp Up Currency Hedging as Trump Tariffs Spark Losses

Tariffs and a sliding US dollar are driving companies to ramp up currency hedging after absorbing multi-million-dollar hits in the fourth quarter, a sign that trade wars are squeezing profits and reshaping corporate risk strategy, according to a MillTech survey.

Eight in 10 of the companies polled by MillTech, the execution and technology arm of currency manager Millennium Global Investments Ltd , experienced losses from unhedged currency positions last quarter. US firms lost an average $9.9 million, while the average loss for UK firms was roughly £6.7 million ($9.1 million). Some companies reported losses exceeding $25 million.

MillTech’s report highlights the growing impact on the US dollar of tariff threats and waning confidence in economic policy. The launch of President Donald Trump ’s trade war last year catalyzed major currency moves — among them the dollar’s steepest first-half slide since the 1970s. A Bloomberg gauge of the dollar fell 8% last year.

Ongoing uncertainty about how much the Federal Reserve will cut rates and the pace of inflation is forcing treasurers to spend money on increasingly expensive hedging strategies, further pressuring profits.

In the UK, sterling fell to a seven-month low against the dollar and its weakest level against the euro in more than two years before rebounding, underscoring the volatility confronting corporate treasurers, said MillTech.

Global firms are exposed to cross-currents in exchange rates. For US multinationals, a weak dollar that boosts the value of overseas earnings and makes their exports more competitive can also raise the cost of producing goods overseas.

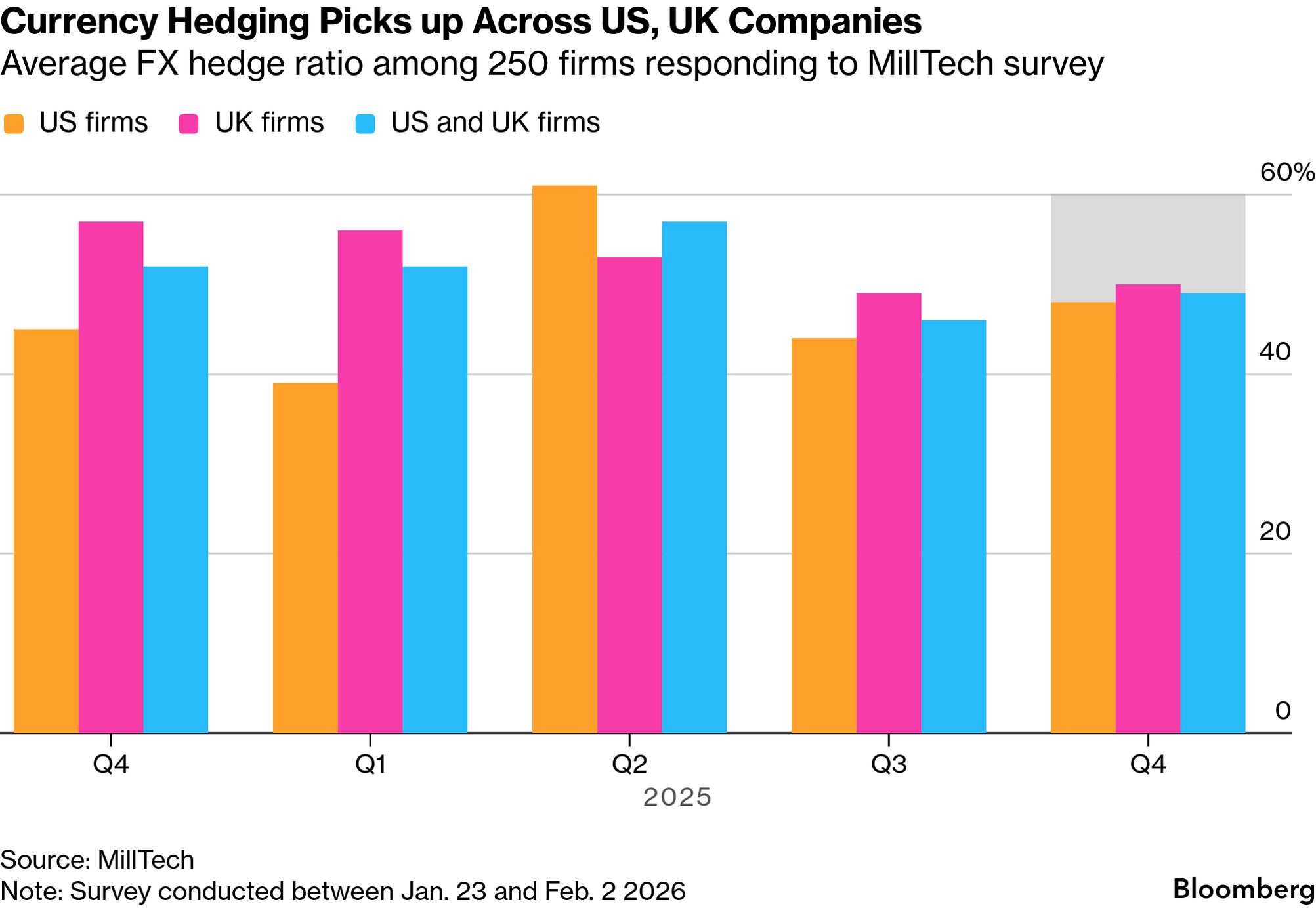

Sharp currency swings encouraged treasurers to seek protection during the fourth-quarter. Treasurers on average protected 49% of their foreign-exchange exposure using financial instruments, up about three percentage points compared to the third quarter, according to the MillTech’s survey. Nearly two-thirds of the businesses said they plan to raise their hedge ratios this year in light of tariff-driven market volatility.

Read more:

The fourth quarter of last year “marked a clear shift back towards defensive FX management,” Eric Huttman , MillTech’s chief executive officer, said in a report accompanying the survey. He said, however, that protection levels have not yet returned to where they were when Trump began his second term last year. Companies are hesitating because hedging costs have increased, he said.

MillTech surveyed 250 chief financial officers, treasurers and other senior financial executives at UK and US corporations with a market value of between $50 million and $1 billion between Jan. 23 and Feb. 2.