Dollar Set for Best Week Since October as Fed Rate-Cut Bets Fade

The dollar is poised to notch its best week in four months as traders pare back expectations for Federal Reserve interest-rate cuts while geopolitical risks boost the currency’s haven appeal.

The has climbed 0.9% this week, set for its biggest gain since October. Heightened inflation concerns and recent US economic data have clouded the outlook for Fed easing this year, buoying the US currency. A continued buildup of US forces in the Persian Gulf has also burnished the appeal of the dollar, a popular destination during uncertain times.

“Markets are shifting towards a higher probability of US and Iranian engagement,” said Richard Cochinos , a currency strategist at RBC Capital Markets. “The upward pressure on oil really keeps the euro and the Japanese yen from being seen as a safe haven, so the dollar steps in to fill that void.”

The yen has fallen more than 1% during the week to trade close to 155 per dollar. The euro has dropped 0.9% over the period to $1.1758.

The dollar has been under pressure in recent months as other major central banks held rates steady or signaled hikes, while the Fed was seen delivering further cuts — a view bolstered by President Donald Trump’s nomination of Kevin Warsh to become the next Fed chair. Uncertainty over US trade policy also weighed on the greenback, which saw its biggest drop in eight years in 2025.

Wary Fed

Minutes from the Fed’s latest meeting, however, that officials were surprisingly wary of cutting interest rates when they met last month, with several suggesting the central bank may need to eventually raise borrowing costs if inflation remains stubbornly high.

Later in the week, a run of economic data — including a in jobless claims — further undermined the case for reducing rates aggressively. Traders were pricing in about 58 basis points of cuts for this year, compared to 63 basis points at the end of last week.

Read more:

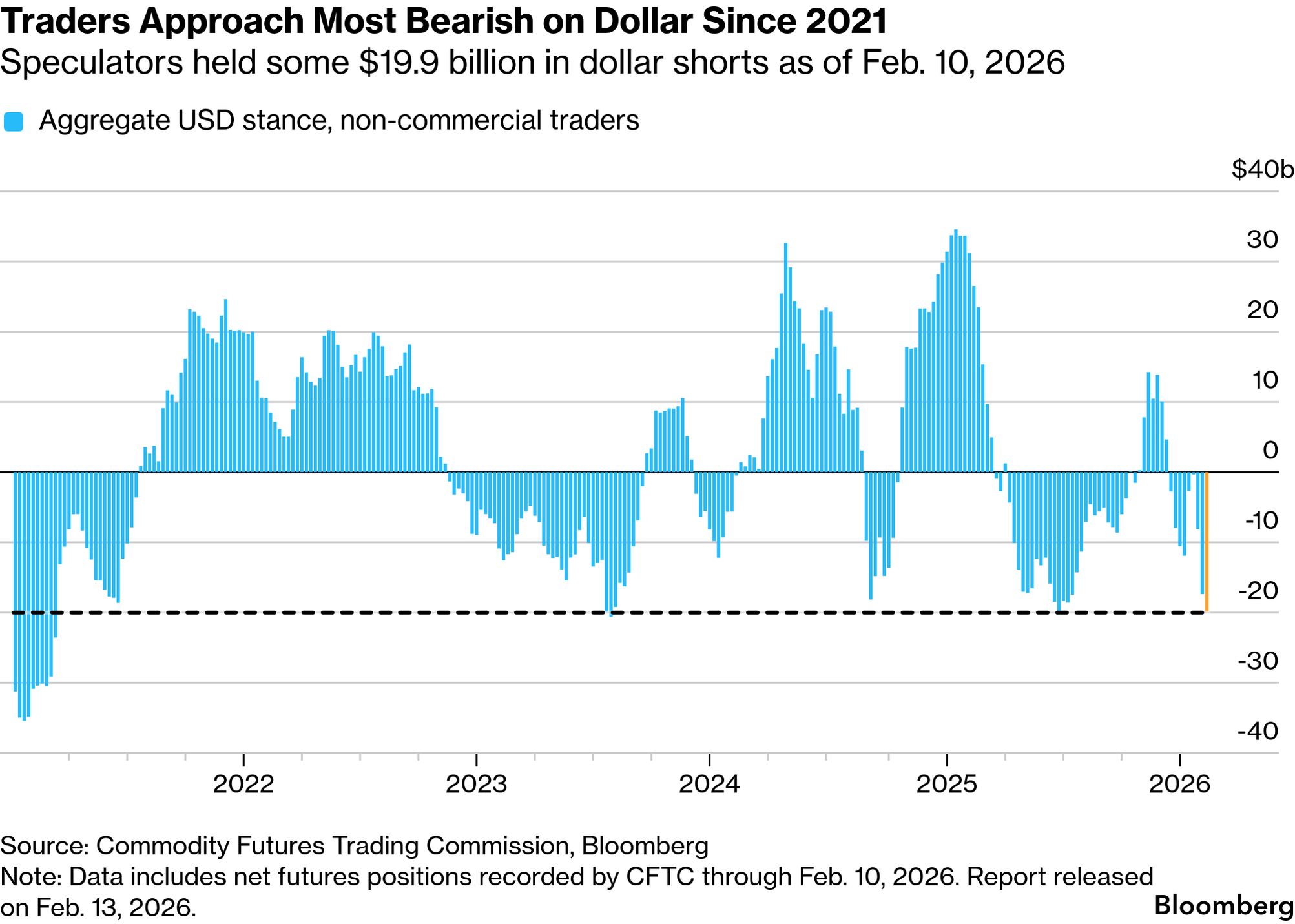

Continued strength in US economic data may force bearish investors to unwind their bets, potentially adding more fuel to the dollar’s run. Speculative traders added to their short dollar bets last week, becoming the most negative on the greenback since June, data from the Commodity Futures Trading Commission show. The latest report from the CFTC is expected on Friday.

The US will also report December personal consumption expenditures data on Friday, as well as gross-domestic-product numbers for the last quarter of 2025.

“This week’s better tone in the dollar recognizes the less bad outlook for the US economy,” said Jane Foley , head of foreign-exchange strategy at Rabobank. “While the market may not be in the mood to build heavy dollar longs, we see the potential for further short-covering if US data continue to surprise in the upside.”

Of course, there are plenty of dollar bears that believe the currency’s decline is yet to run its course. Nathan Thooft , a senior portfolio manager at Manulife Investment Management, said that while “Iran is certainly the bigger theme at the moment,” the greenback is likely to weaken further over time.

“We remain in the camp of a longer secular downtrend in the dollar,” he said. However, “there will certainly be shorter time frames where the dollar exhibits strength.”