Euro Near One-Month Low as US-Iran Risks Fuel Downside Bets

The euro is hovering near its lowest level in a month as the US positions forces for a potential strike on Iran, denting risk appetite and boosting the dollar.

The common currency has slid about 0.8% this week, its worst performance in three months, and is headed for its eighth decline in nine sessions. It is trading around $1.1765 in London, with the latest leg lower coming as oil prices hit a six-month high and the US increased pressured Iran to reach a deal over its nuclear program.

Resilient US data had already been weighing on the euro by pushing investors to pare back expectations for Federal Reserve rate cuts. Geopolitics has now added another tailwind for the greenback, with higher crude prices feeding into the dollar’s broader bid, said Kirstine Kundby-Nielsen , a FX analyst at Danske Bank.

US President Donald Trump has given Iran 15 days at most to strike a deal. The US is deploying a vast array of forces ahead of a potential strike on the major oil producer, the biggest buildup since 2003.

The euro remains overvalued while geopolitical risks haven’t yet been priced in, according to Francesco Pesole , FX strategist at ING Bank NV. This “means greater downside risks for EUR/USD, which we believe can trade all the way down to 1.16 in a major escalation,” he said.

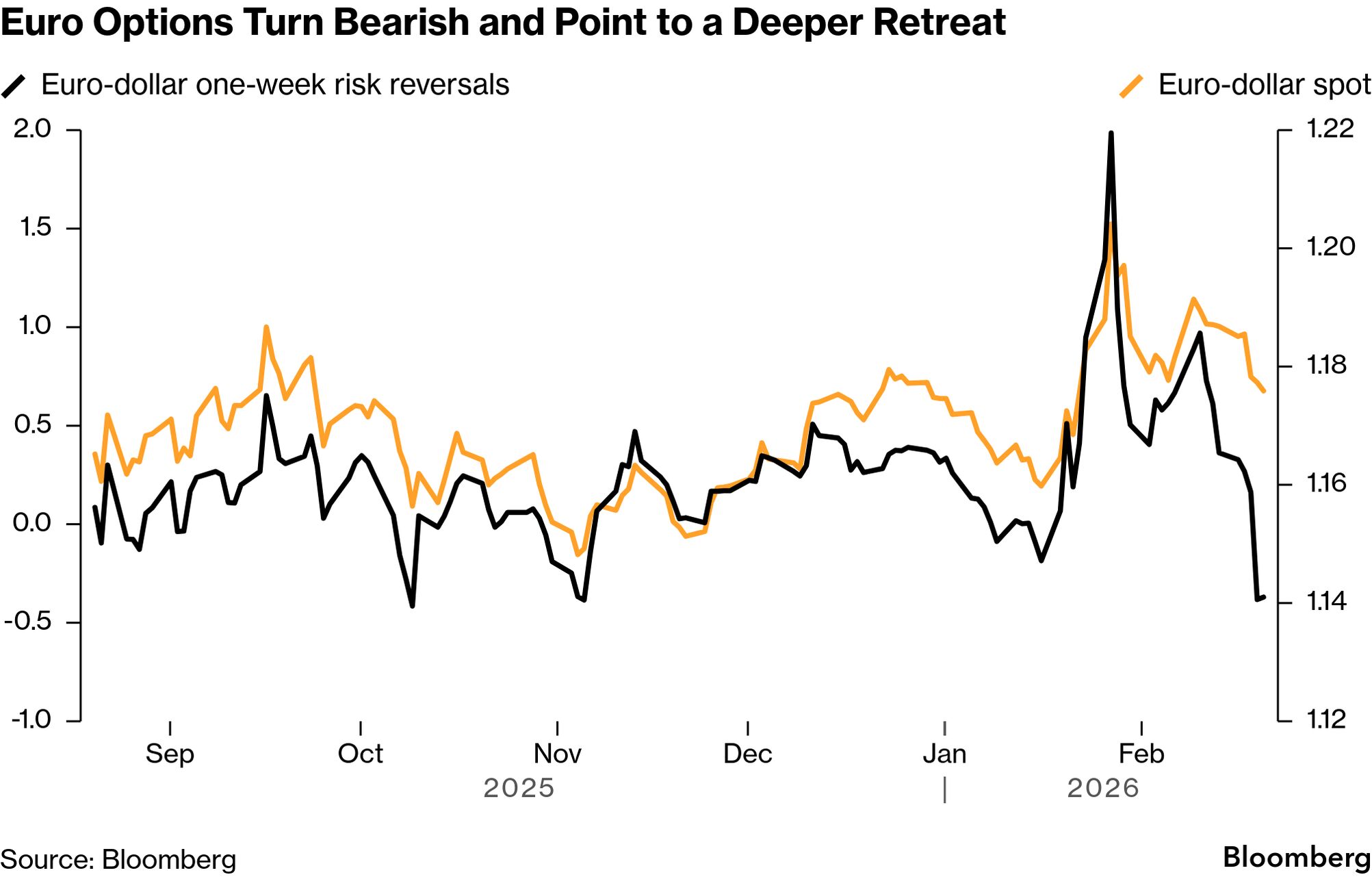

Options markets are aligning with the move. Short-dated positioning has turned the most bearish since October, according to risk reversals, a barometer of market positioning and sentiment. Data from the Depository Trust & Clearing Corporation show traders are focusing on the $1.17 area — the most heavily used euro-put strike this week — and meaningful demand is extending toward $1.15.

Most of the bets expire over the next month, showing traders are focused on protecting against near-term euro weakness, rather than positioning for a big, long-term collapse.